Is It Better to Buy or Rent? The Honest Guide to Deciding What’s Right for You

With high home prices and mortgage rates that feel like they’ve had too much coffee, you might be wondering: Is it even worth trying to buy a home right now?

Honestly? Maybe not. Buying a home isn’t a one-size-fits-all solution. It should happen when you’re ready, financially able, and emotionally prepared to know what a septic inspection is. (Seriously, it’s a thing.)

But here’s where it gets interesting: While renting might seem like the safer or only choice today, in the long run, it can cost you a lot more than you think.

Renting: The Flexible Frenemy

Renting gets you:

- Mobility: Want to chase a job in Seattle or just move to a quieter street? No problem.

- Lower Upfront Costs: Usually just a security deposit and first & last month’s rent.

- Maintenance-Free Living: Someone else gets to snake the drain. Yay.

But here’s the catch…

The Biggest Downside of Renting

According to a recent Bank of America survey, 70% of renters worry about what long-term renting means for their future. And they’re not wrong.

Because rent doesn’t build wealth. It pays your landlord’s mortgage – not yours.

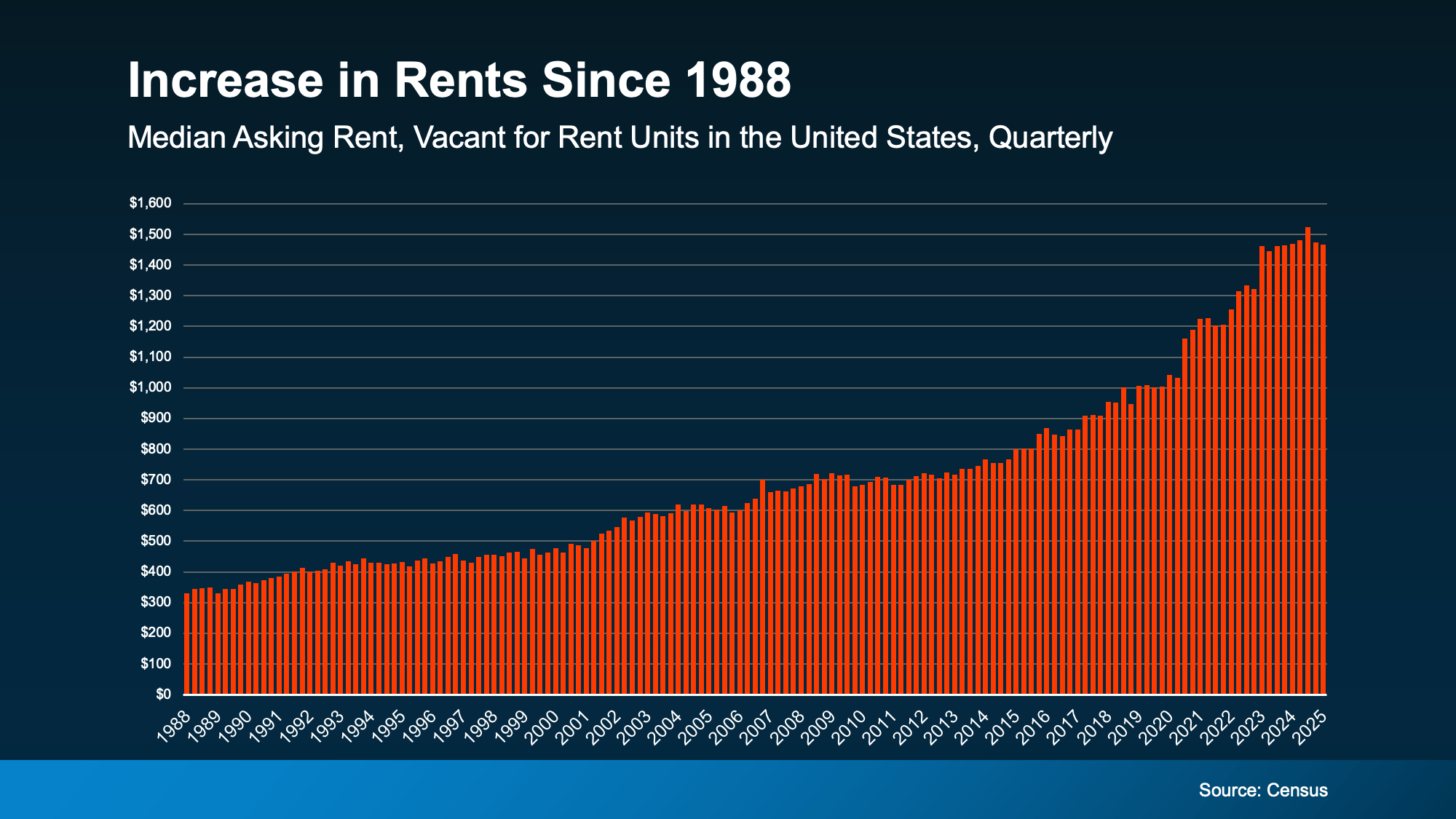

As shown in this Bank of America data, rent prices have steadily increased over the decades:

Image Source: CFPB Rent Trends

Why Buying a Home Might Be Your Wealth-Building Secret

Let’s break it down.

Homeownership Builds Wealth Over Time

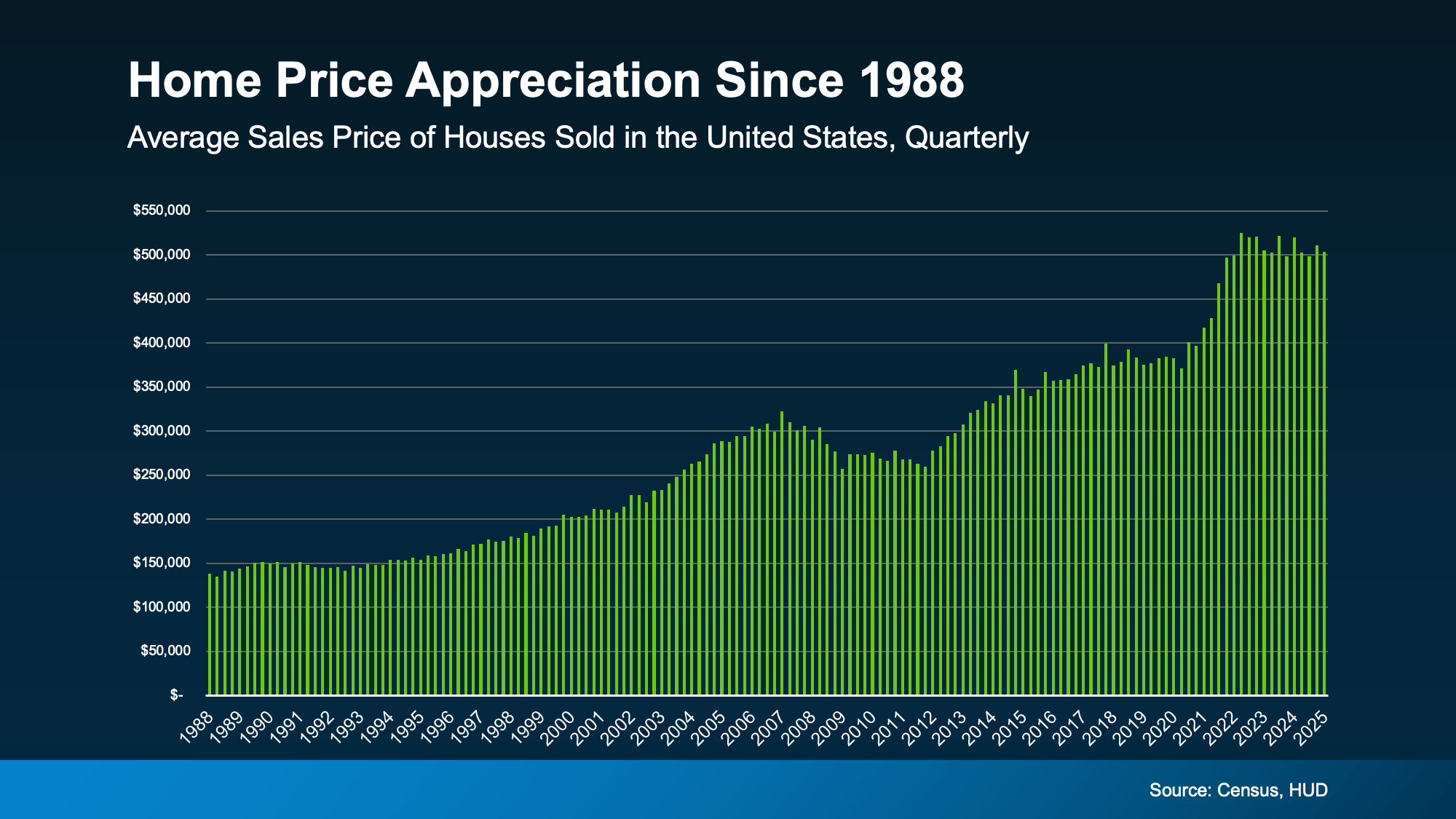

Buying a home is more than just planting roots – it’s planting money.

As home values rise over time, your equity grows with every mortgage payment. And that equity? It’s part of your net worth.

Image Source: Keeping Current Matters

In fact, the average homeowner’s net worth is nearly 40x that of a renter. Don’t believe it? Check out this chart:

Image Source: Consumer Finance Bureau

“Owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.” — Forbes

Renting vs. Buying: A Quick Comparison

| Criteria | Renting | Buying |

| Upfront Costs | Low: First,last month + deposit | Higher: Down payment + closing costs |

| Monthly Payments | Possibly lower, but variable | Fixed (with fixed-rate mortgage) |

| Maintenance | Landlord handles it | You (and YouTube) handle it |

| Wealth Building | No equity | Equity grows with time |

| Flexibility | High | Lower |

| Personalization | Limited | Unlimited (yes, even flamingo wallpaper) |

Where to Rent or Buy in Boston’s Suburbs

If you’re on the fence, explore neighborhoods with both buying and renting opportunities:

- Dedham: Suburban oasis, urban access

- Newton: Schools, community, investment potential

- Walpole: Affordable charm, great starter homes

- West Roxbury: City access, neighborhood feel

- Roslindale: Creative energy, diverse vibes

So… Should You Buy or Rent?

Rent if:

- You move often

- You’re saving for a down payment

- You’re not sure where you want to settle

Buy if:

- You’re ready to invest long-term

- You have savings

- You want to build equity

“In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.” — Joel Berner, Realtor.com

Bottom Line

Renting may feel more doable today, but it won’t help you build wealth.

The first step toward getting out of the rental trap is setting a plan. That’s where I come in.

Let’s Connect

Whether you’re ready now or just need to test-drive a few neighborhoods, I’d love to help.

Contact me for a personalized plan or free home valuation

Let’s turn your real estate questions into a confident next step.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link