The Housing Market Is Turning a Corner Going into 2026

After several years of high mortgage rates, buyer hesitation, and sellers clinging to their 3% loans like a Dunkin’ iced coffee on the first 70-degree day, momentum is quietly building beneath the surface of the housing market.

Sellers are reappearing. Buyers are re-engaging. And for the first time in what feels like forever…things are actually moving again.

No, it’s not a surge. But it is a shift… and it’s one that could set the stage for a stronger, more balanced year in 2026 across communities like Walpole, West Roxbury, Dedham, Roslindale, Norfolk, Westwood, and Wrentham.

So, what exactly is changing?

Here are the three big trends breathing life back into the housing market right now with the real data to back it up.

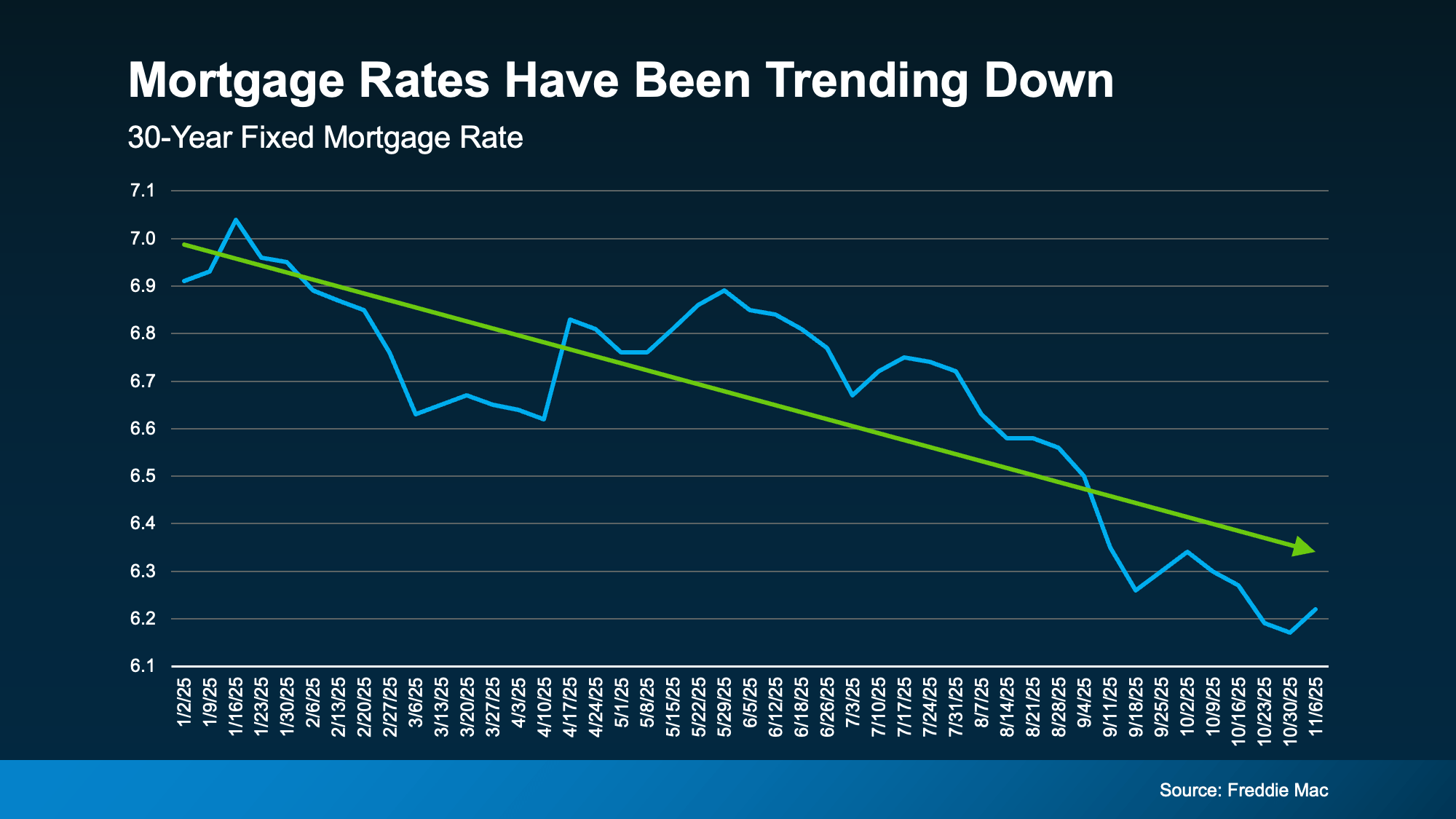

1. Mortgage Rates Have Been Trending Down (Finally!)

Mortgage rates are always going to bounce around. That’s just what they do… They rise, fall, spike, calm down, and occasionally remind us all to practice deep breathing. But when you zoom out and look at the bigger picture, one trend is extremely clear:

Rates have been trending downward for most of 2025.

Mortgage Rates: Sloping Downward All Year

This is the most consistent downward movement we’ve seen in years, and in the past few months, buyers have actually benefited from the best rates of 2025.

Sam Khater, Chief Economist at Freddie Mac, explains why this matters:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

What falling rates mean for buyers in our area

Lower rates = lower borrowing costs = more buying power.

Simple math. Big impact.

According to Redfin, a buyer with a $3,000/month mortgage budget can now afford about $25,000 more home than they could just a year ago.

That may mean:

- Moving from a 2-bed to a 3-bed in Dedham

- Getting a yard instead of a patio in West Roxbury

- Actually competing in multiple-offer situations in Walpole

- Not sacrificing the garage in Westwood

- Or getting closer to town centers in Roslindale

The bottom line?

More buyers are finding they can say “yes” again and they’re jumping back in.

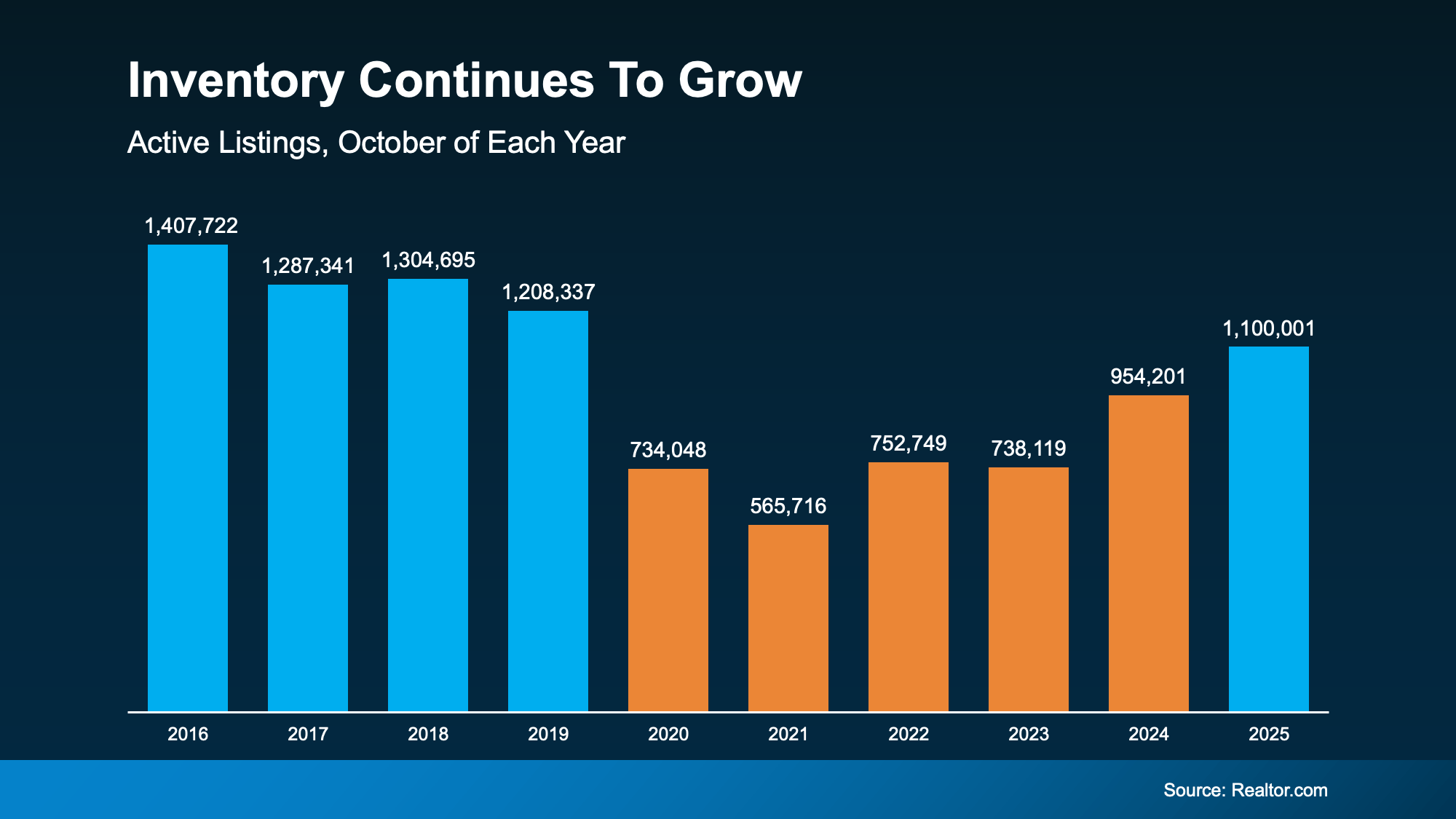

2. More Homeowners Are Finally Ready To Sell

For years, homeowners with ultra-low mortgage rates stayed put, creating the “rate-lock effect.”

No one wanted to give up their 2.8% mortgage (and honestly, who can blame them?).

But that’s changing.

Inventory Is Rising for the First Time in Years

We’re seeing the number of homes for sale growing and not just a little. Inventory is climbing toward levels we haven’t seen in 6 years.

What’s driving sellers back into the market?

- People outgrowing their homes

- Downsizing

- Job changes

- Relocations

- Relationship changes

- Babies

- Empty nests

- Aging parents

- More space needed for work-from-home

- Or simply: “We’ve been waiting for years… let’s just do it.”

And as rates move downward, the fear of trading in a low rate is slowly fading.

How rising inventory impacts buyers

This is a very good thing.

More homes means:

- More choices

- Less frantic bidding

- More balance

- A healthier market overall

Communities like Walpole, Norfolk, Wrentham, Dedham, and Westwood are all seeing this trend firsthand. Homeowners who paused in 2023–2024 are finally making their move.

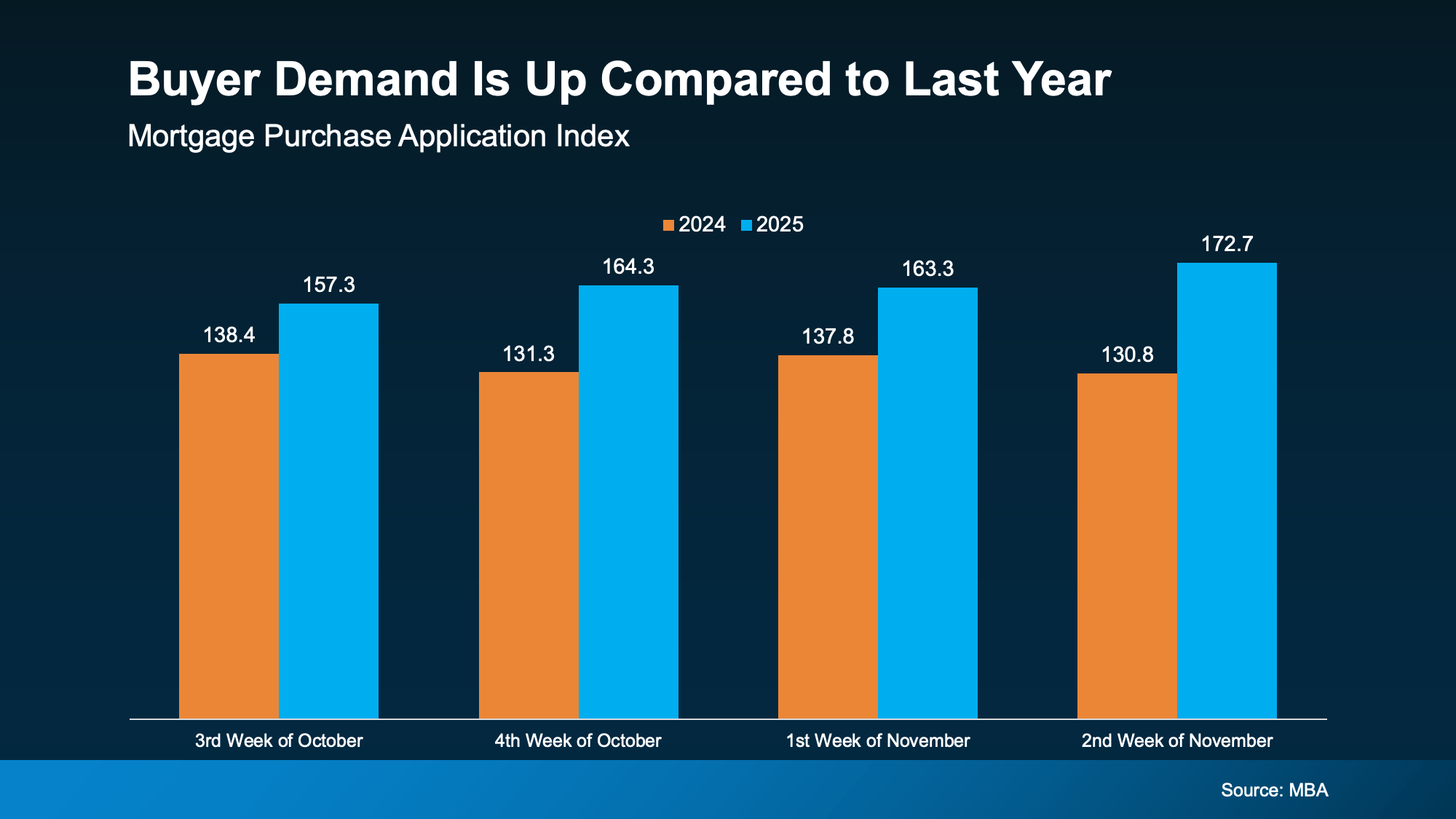

3. Buyers Are Re-Entering the Market And The Data Proves It

Buyers aren’t just window shopping online, they’re actively applying for mortgages again.

The Mortgage Bankers Association reports that purchase applications are up compared to last year.

Buyer Demand Is Up Compared to 2024

Week after week this fall, 2025 is outperforming 2024 in purchase activity. That’s a clear sign that demand is real, not theoretical.

Why this matters heading into 2026

Economists from:

- Fannie Mae

- MBA

- National Association of Realtors (NAR)

…all forecast moderate but steady sales growth heading into 2026.

No one’s predicting a boom. No one’s expecting a frenzy.

Instead, the projection is something we haven’t had in years:

A normal-ish, stable, active market.

Across Greater Boston suburbs from West Roxbury to Walpole, Westwood to Roslindale, this stability is exactly what many buyers and sellers have been waiting for.

So… Is the Market “Back”?

It’s not roaring.

It’s not sluggish.

It’s not chaotic.

It’s not frozen.

It’s simply turning a corner.

And that is very, very good news.

Here’s what’s happening right now:

- Mortgage rates are trending down

- More listings are coming on

- Buyers are stepping back in

- Competition is rising, but not overwhelming

- Sellers are gaining confidence

- Buyers are gaining options

If you’re planning a move in 2026, whether buying or selling, your window of opportunity is opening.

Bottom Line

After several slower-than-normal years, the housing market is finally shifting into a healthier, more active phase.

Declining mortgage rates, an increase in listings, and rising buyer activity all point to real momentum, especially across our local communities.

If you want to understand what this means for the value of your home or for your buying power, I’d love to walk you through it.

Let’s connect today.

Get your free home valuation or schedule a buyer consultation for 2026 planning.