The Price You Set Can Make (or Break) Your Home Sale

The One Decision That Impacts Everything

When you decide to sell your home in Walpole, West Roxbury, Roslindale, Dedham, Norfolk, Wrentham, or Westwood, there’s one decision that determines almost everything that follows.

Not the staging.

Not the photos.

Not even the open house.

It’s the price.

Your asking price determines whether buyers rush to see your home… or scroll right past it. Whether you receive strong offers quickly… or end up reducing the price weeks later.

And in today’s Massachusetts market — where buyers have more options than they did two years ago — pricing strategy matters more than ever.

The #1 Pricing Mistake Sellers Are Making Right Now

If you’re thinking about moving, your first instinct may be to check an online home value estimator.

It’s fast.

It’s free.

It doesn’t require talking to anyone.

But here’s the uncomfortable truth:

Online tools don’t know your house.

They don’t know the new roof you installed.

They don’t know the updated kitchen in your Westwood colonial.

They don’t know that your Roslindale two-family is steps from the commuter rail.

They don’t know your Walpole neighborhood is suddenly getting multiple-offer attention again.

They’re working off public data — and often delayed data at that.

And that lag can cost you.

Where Online Home Value Estimates Fall Short

Online pricing tools rely heavily on:

- Closed sales (which reflect the market from 30–90 days ago)

- Public records

- Square footage

- Lot size

- Automated algorithms

What they can’t see:

- Your home’s condition

- Renovations not reflected in public data

- Buyer behavior happening right now

- Hyper-local trends (like how West Roxbury and Dedham are performing differently this month)

Even small pricing errors can create big consequences:

- Price too high? Buyers skip your listing and momentum dies.

- Price too low? You may leave thousands on the table.

- Price “almost right”? You sit long enough to look stale.

In real estate, perception becomes reality very quickly.

What Sellers Actually Believe About Home Values

Here’s what’s interesting.

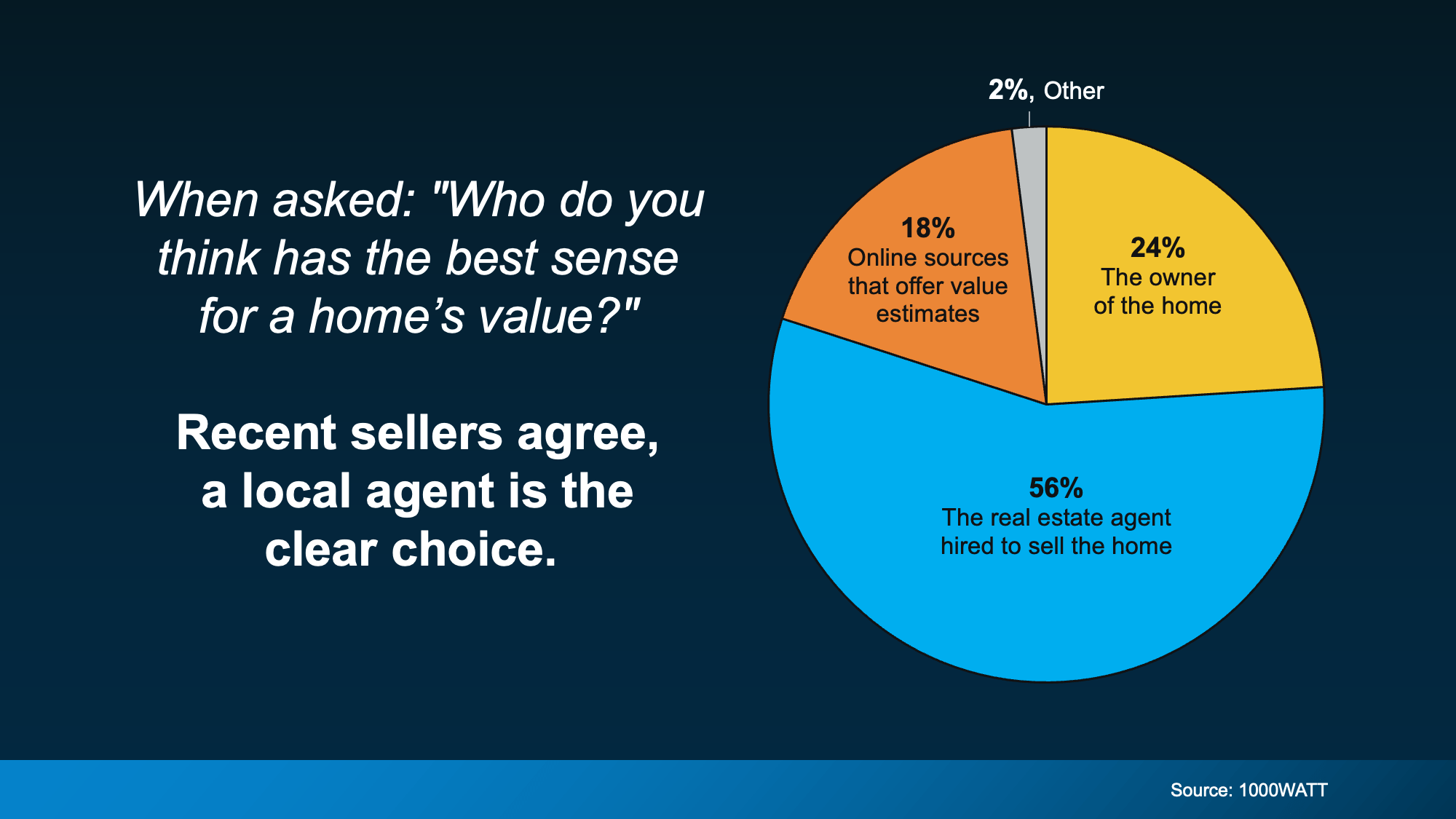

When asked:

“Who do you think has the best sense for a home’s value?”

Recent sellers overwhelmingly chose the real estate agent hired to sell the home.

According to 1000WATT:

- 56% say the real estate agent hired to sell the home

- 24% say the homeowner

- 18% say online sources

- 2% say other

That’s not accidental.

Sellers know that when it comes time to actually sell — not just browse — experience matters.

What a Local Walpole-Area Agent Brings to Pricing Strategy

A strong pricing strategy is not about guessing.

It’s about:

1️⃣ Knowing What Buyers Are Paying This Month

Not last quarter.

Not last year.

For example:

- A colonial in Westwood may perform differently than one in Norfolk.

- A ranch in Dedham may attract downsizers willing to pay a premium.

- A Roslindale single-family may be competing directly with Jamaica Plain buyers stretching budgets.

That nuance doesn’t show up in an algorithm.

2️⃣ Understanding Active Competition

Pricing isn’t just about past sales.

It’s about:

- What’s currently for sale

- How long those homes have been sitting

- Which ones just went under agreement

- What buyers are reacting to right now

In Walpole and Wrentham especially, the difference between $649,900 and $669,900 can completely change your buyer pool.

3️⃣ Seeing the Subjective Details That Matter

A professional agent walks through your home and evaluates:

- Flow and layout

- Natural light

- Condition vs. competition

- Updates that add real value

- Features buyers are paying more for today

Online tools can’t smell fresh paint.

They can’t feel how bright your sunroom is.

They can’t sense how desirable your street actually is.

But buyers can.

And I can.

The Hidden Cost of Overpricing

Let’s talk about something sellers don’t always see coming.

When a home hits the market overpriced:

- Showings are slower

- Feedback becomes hesitant

- Days on market increase

- Buyers begin to wonder “what’s wrong with it?”

Eventually, a price reduction happens.

But by then?

Momentum is gone.

And homes that reduce price often sell for less than if they had been priced correctly from the beginning.

In a market like Norfolk County right now — balanced but not frantic — precision matters.

The Hidden Cost of Underpricing

On the flip side:

If you rely on an online estimate that undervalues your home, you could:

- Leave equity on the table

- Undersell improvements

- Miss opportunities for competitive offers

I’ve walked into homes in West Roxbury and Walpole where the Zestimate was tens of thousands below what buyers were actually willing to pay.

That’s not a small difference.

That’s a vacation home difference.

Or retirement cushion difference.

Or “college tuition just got easier” difference.

Pricing Is Strategy — Not Just a Number

The right price:

- Attracts serious buyers quickly

- Creates urgency

- Generates stronger offers

- Protects your negotiating power

- Minimizes time on market

The wrong price?

Creates friction from day one.

And in towns like Dedham, Roslindale, Walpole, Westwood, Norfolk, and Wrentham — where buyers are savvy and inventory is shifting — you don’t get a second “first impression.”

Bottom Line

Online home value tools can give you a starting point.

But when real money is on the line, starting points aren’t enough.

If you want:

- The strongest possible sale price

- The least amount of stress

- A strategy built specifically for your neighborhood

Then you need more than an algorithm.

You need someone who works these towns every single day.

If you’re thinking about selling in Walpole, West Roxbury, Roslindale, Dedham, Norfolk, Wrentham, or Westwood:

Let’s determine the right price — not just the easy one.

Get your free, no-obligation home valuation today.

Expert Forecasts Point to Affordability Improving in 2026

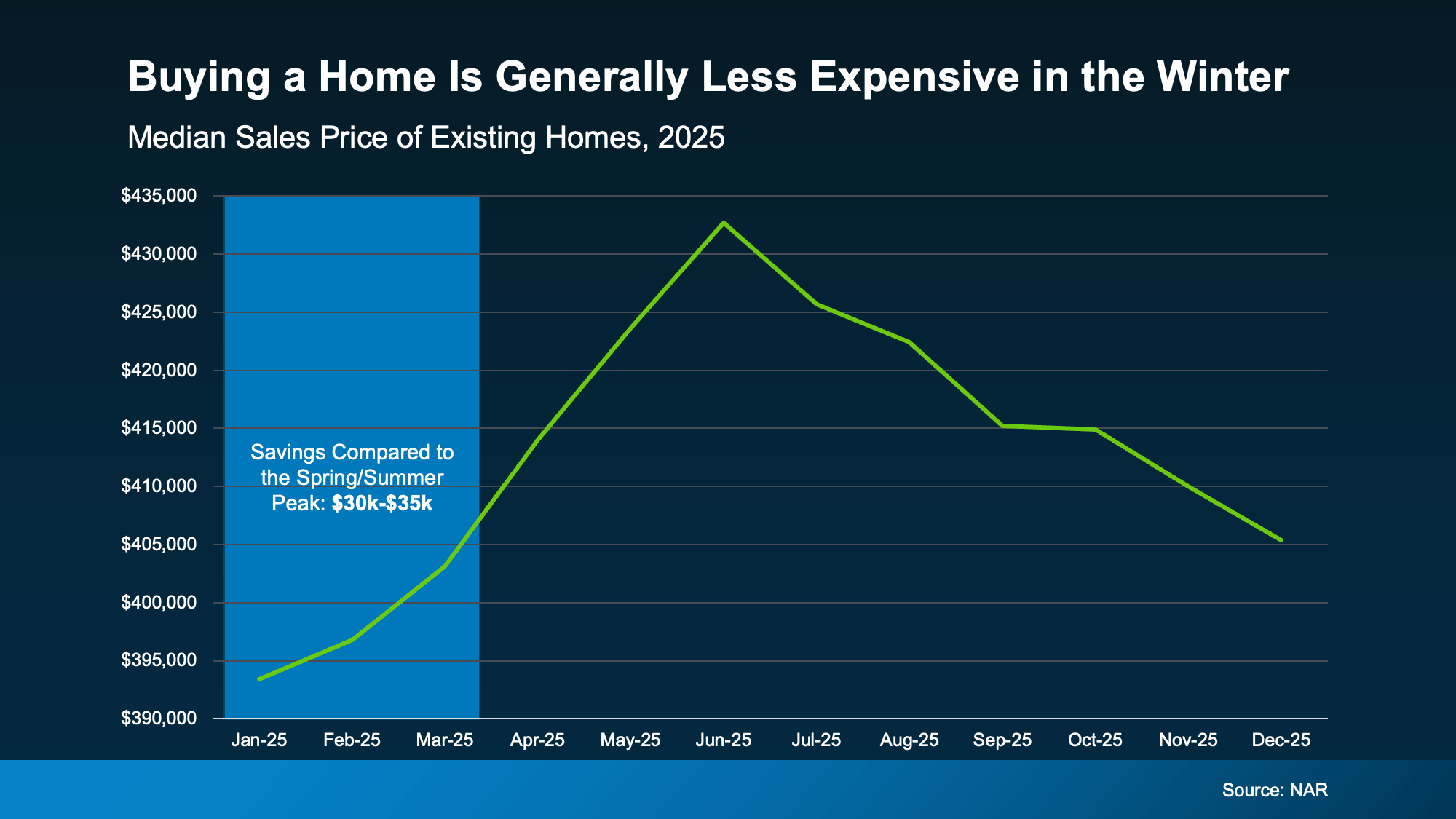

Wondering what to expect from the housing market in 2026? You’re not the only one. For the past few years, affordability has been the biggest barrier standing between most people and their next move. And a lot of buyers and sellers have been holding their breath waiting for things to get better. The good news? It’s finally happening.

In 2025, affordability was the best it’s been in 3 years. And experts agree the momentum will keep going in 2026. And that’s based on their analysis of the key factors shaping the housing market in the year ahead: mortgage rates, inventory, and home prices.

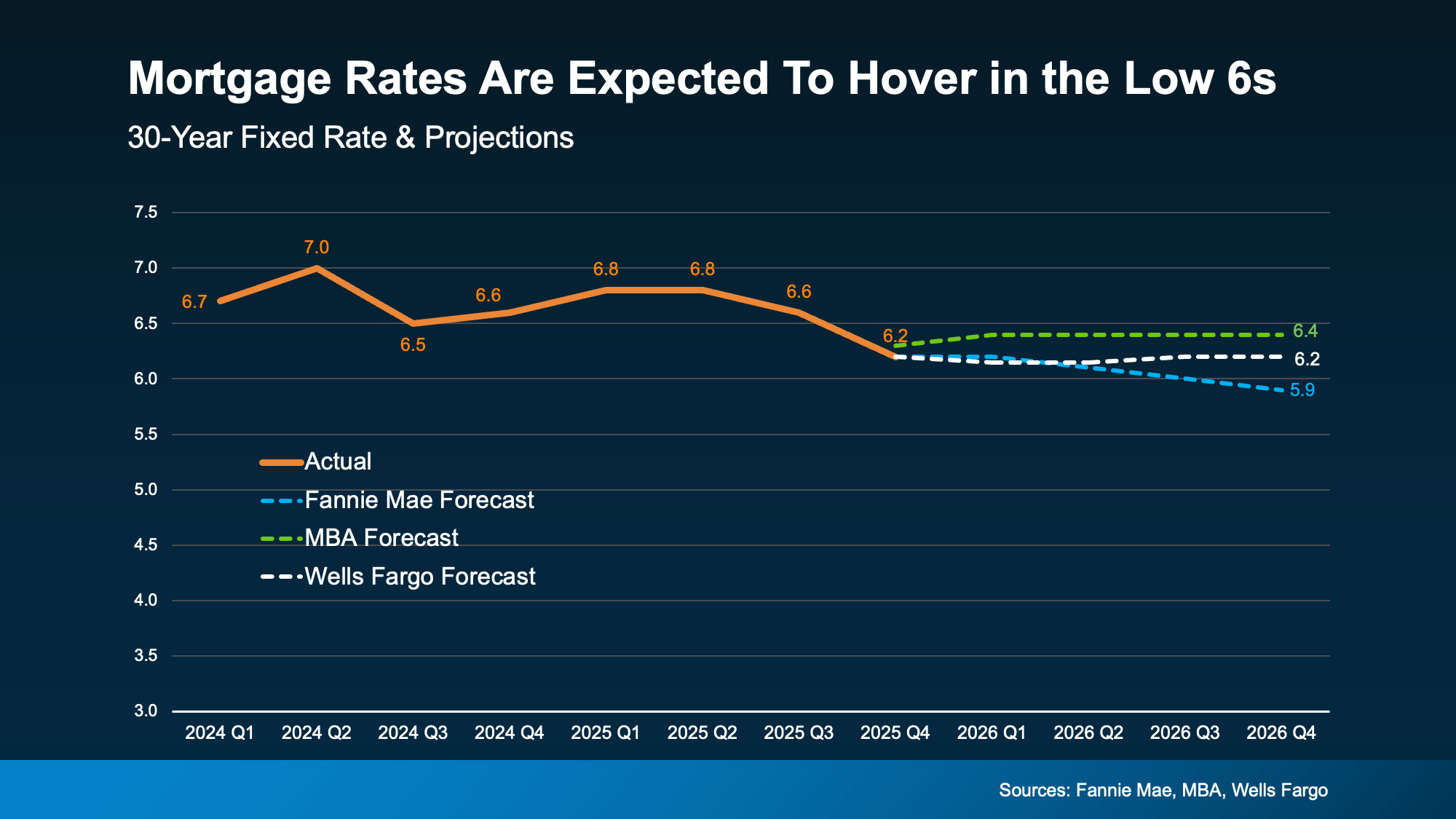

Lower Mortgage Rates Are Already Here

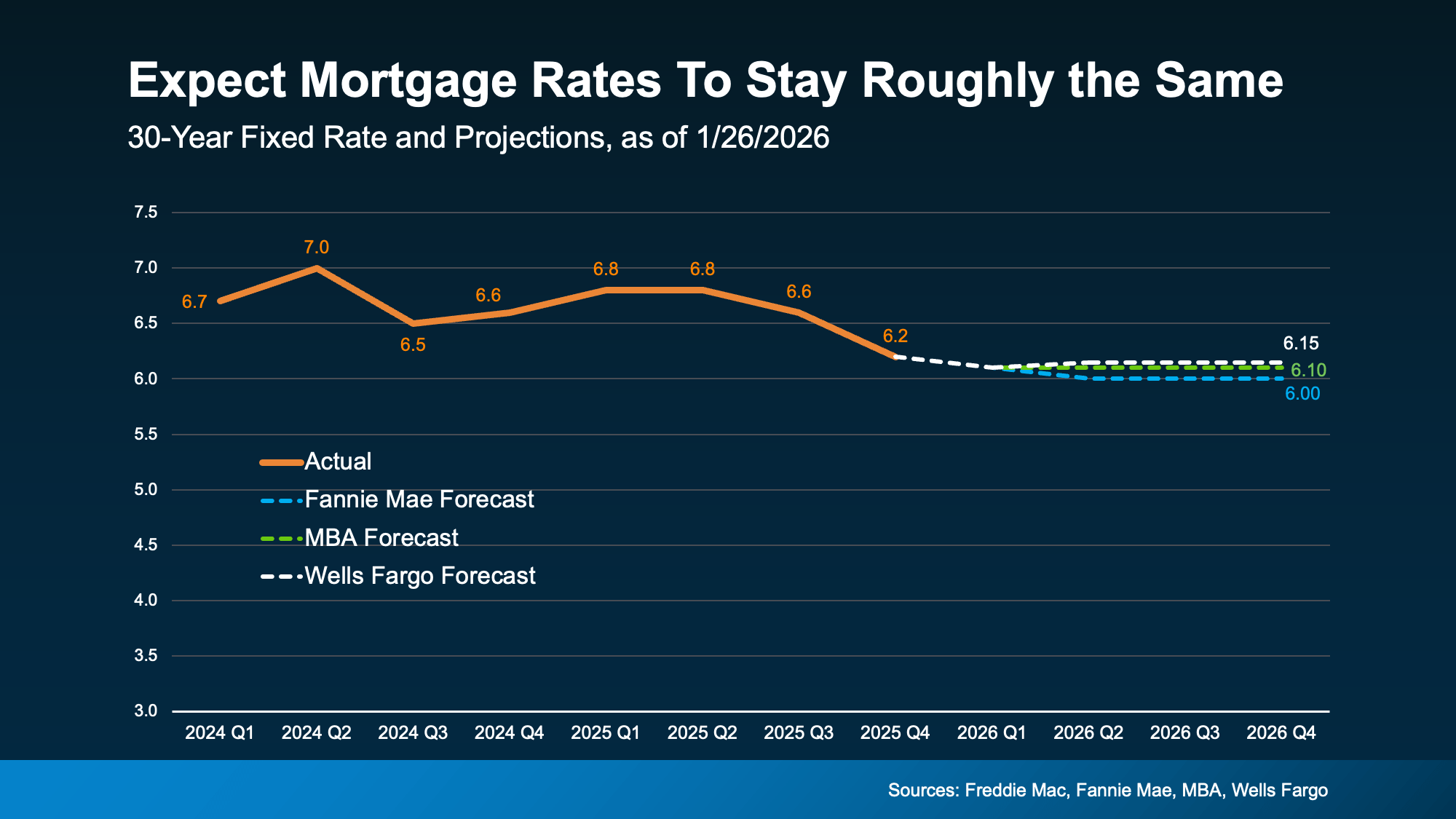

Mortgage rates have already come down from their peak. By some counts, they dropped by almost a full percentage point over the course of the last year. And that’s a big deal, even if it doesn’t sound like it. But how low will they go? And should you wait for them to come down more? Here’s your answer.

Forecasts suggest they’ll stay pretty much where they are now and hover in the low 6% range throughout 2026 (see graph below):

Where they go from here really depends on what happens with the economy, the job market, and any changes in monetary policy the Fed makes in the year ahead. The important thing is, they’re already lower than they were just one year ago and that’s ideal if you’re planning a 2026 move.

Where they go from here really depends on what happens with the economy, the job market, and any changes in monetary policy the Fed makes in the year ahead. The important thing is, they’re already lower than they were just one year ago and that’s ideal if you’re planning a 2026 move.

- For buyers: A lower rate reduces monthly payments and increases buying power. And, that combo helps more people qualify for homes that previously felt just out of reach.

- For sellers: It may be time to accept that rates in the 6s are the new normal. And if you need to move, it’s doable, especially with your equity.

Even More Options Are on the Way

In 2025, the number of homes for sale improved by about 15%. As inventory rose, buyers regained things they hadn’t had in years: options, time to consider those options, and negotiating leverage. That helped restore more balance to the housing market.

Not to mention, the inventory gains are a big piece of what’s helped price growth slow down – which in turn improves affordability.

While the inventory gains this year aren’t expected to be as steep, experts at Realtor.com say the supply of homes for sale should grow by another 8.9% this year.

- For buyers: That means even more choice and more negotiating power.

- For sellers: Pricing your house right will be essential to draw in buyers.

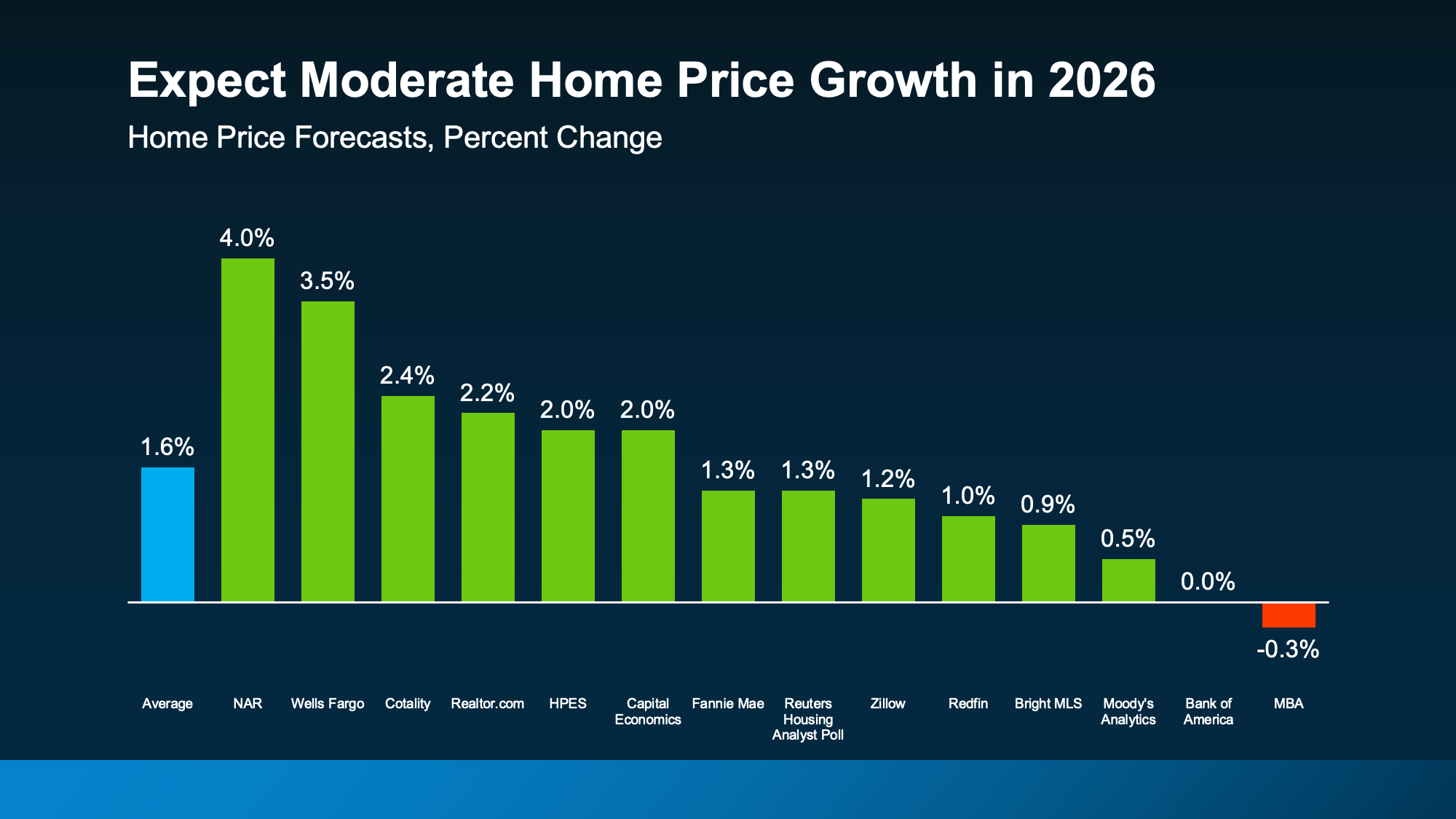

Home Price Growth Is Slowing to a More Sustainable Pace

With more homes for sale, there isn’t as much upward pressure on prices right now. And we’ve seen that shake out over the past year. Even so, the overwhelming majority of experts say, nationally, prices will continue rising in the year ahead – just at a slower pace. On average, they say prices will rise by 1.6% in 2026 (see graph below):

And that’s reassuring if you’ve been fed content on social media saying prices are going to come crashing down. But here’s what you need to remember most about this. It’s going to vary a lot by area.

And that’s reassuring if you’ve been fed content on social media saying prices are going to come crashing down. But here’s what you need to remember most about this. It’s going to vary a lot by area.

So, lean on a local agent for the latest on what’s happening where you are. Some markets will see prices rise more than this. Others may see prices come down slightly. It really all depends on conditions in your local market

But overall, prices will continue to rise at the national level. And that’s good for the market as a whole. As Realtor.com explains:

“For homebuyers and sellers, the shift signals a more balanced market—one where price growth steadies, rate relief offers breathing room, and negotiating power tilts subtly toward buyers.”

- For buyers: Expect more moderate price growth, not the sudden and intense spikes just a few short years ago. That gives you fewer surprises and more predictability, which makes budgeting a whole lot easier.

- For sellers: This slower price growth restores balance without putting your equity at risk. And that’s a win.

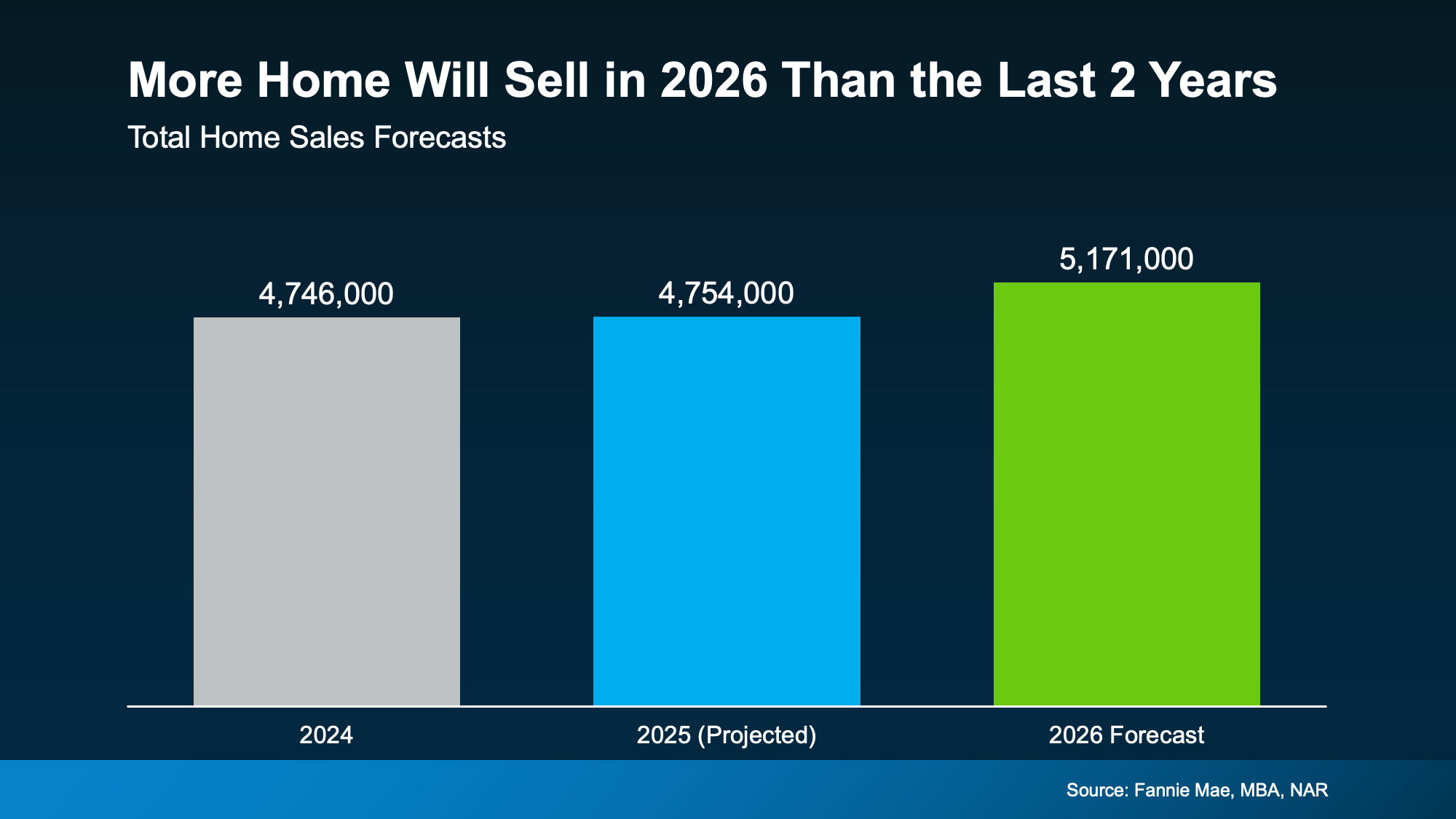

More Homes Will Sell

All of this adds up to a better affordability equation in 2026. And that’s exactly why experts are saying we should see more homes sell (and more people buy) this year.

As Mischa Fisher, Chief Economist at Zillow, says:

As Mischa Fisher, Chief Economist at Zillow, says:

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

The bottom line is, more people are finally going to be able to make their move this year. So, the question is: will you be one of them? The market is giving you an opportunity you haven’t had in a while. Maybe it’s time to take advantage of it.

Bottom Line

Affordability won’t change suddenly overnight. But, with several key trends working together, it should slowly and steadily improve in the months ahead.

That’s exactly why, in 2026, you should see a market with more balance, more predictability, and more breathing room than you’ve had in years.

Want more information about the opportunities unlocking in our local market?

Let’s chat.

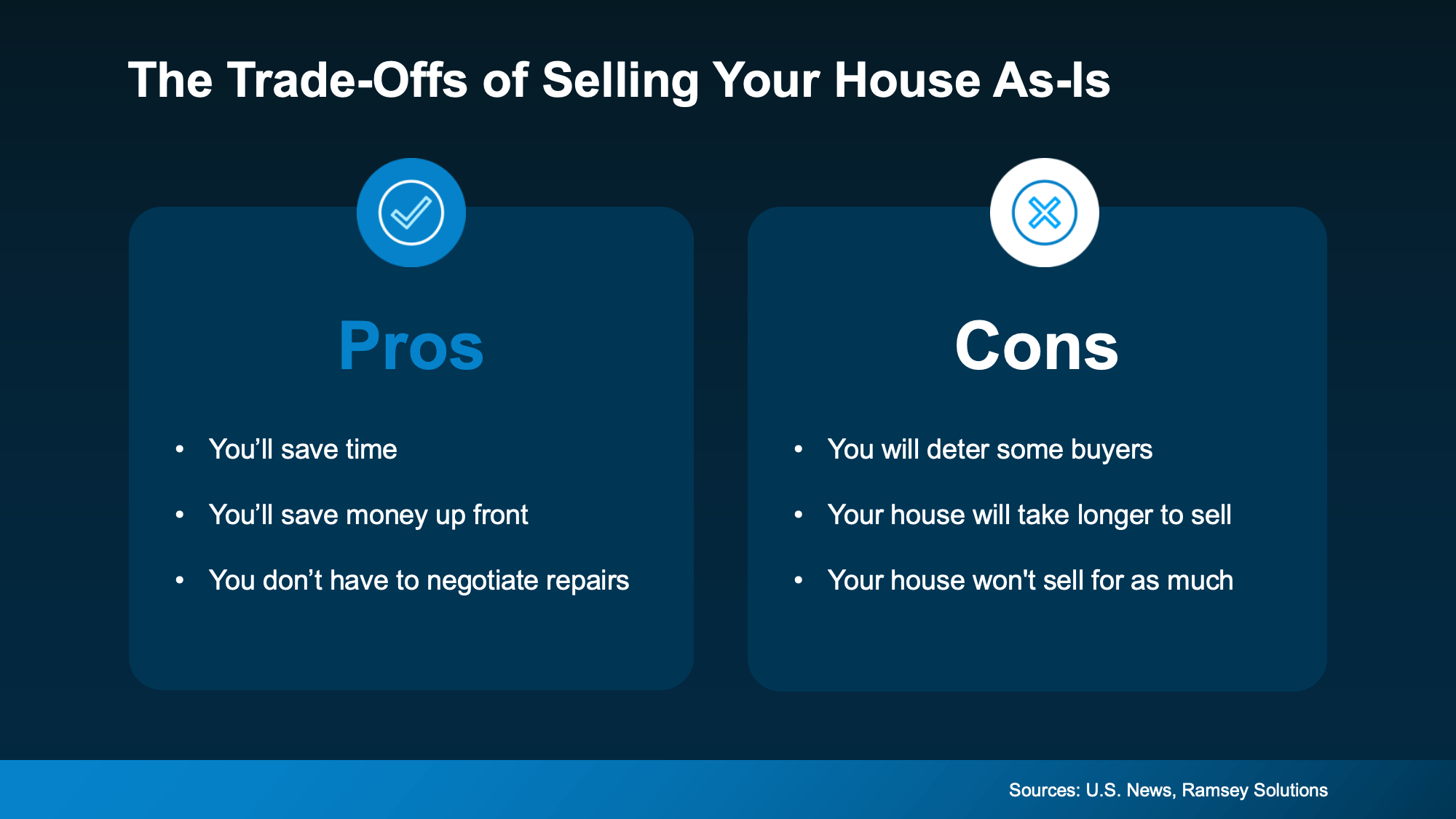

Thinking About Selling Your House As-Is? Read This First

If you’re thinking about selling your house this year, you may be torn between two options:

- Do you sell it as-is and make it easier on yourself? No repairs. No effort.

- Or do you fix it up a bit first – so it shows well and sells for as much as possible?

In 2026, that decision matters more than it used to. Here’s what you need to know.

More Competition Means Your Home’s Condition Is More Important Again

Over the past year, the number of homes for sale has been climbing. And this year, a Realtor.com forecast says it could go up another 8.9%. That matters. As buyers gain more options, they also re-gain the ability to be selective. So, the details are starting to count again.

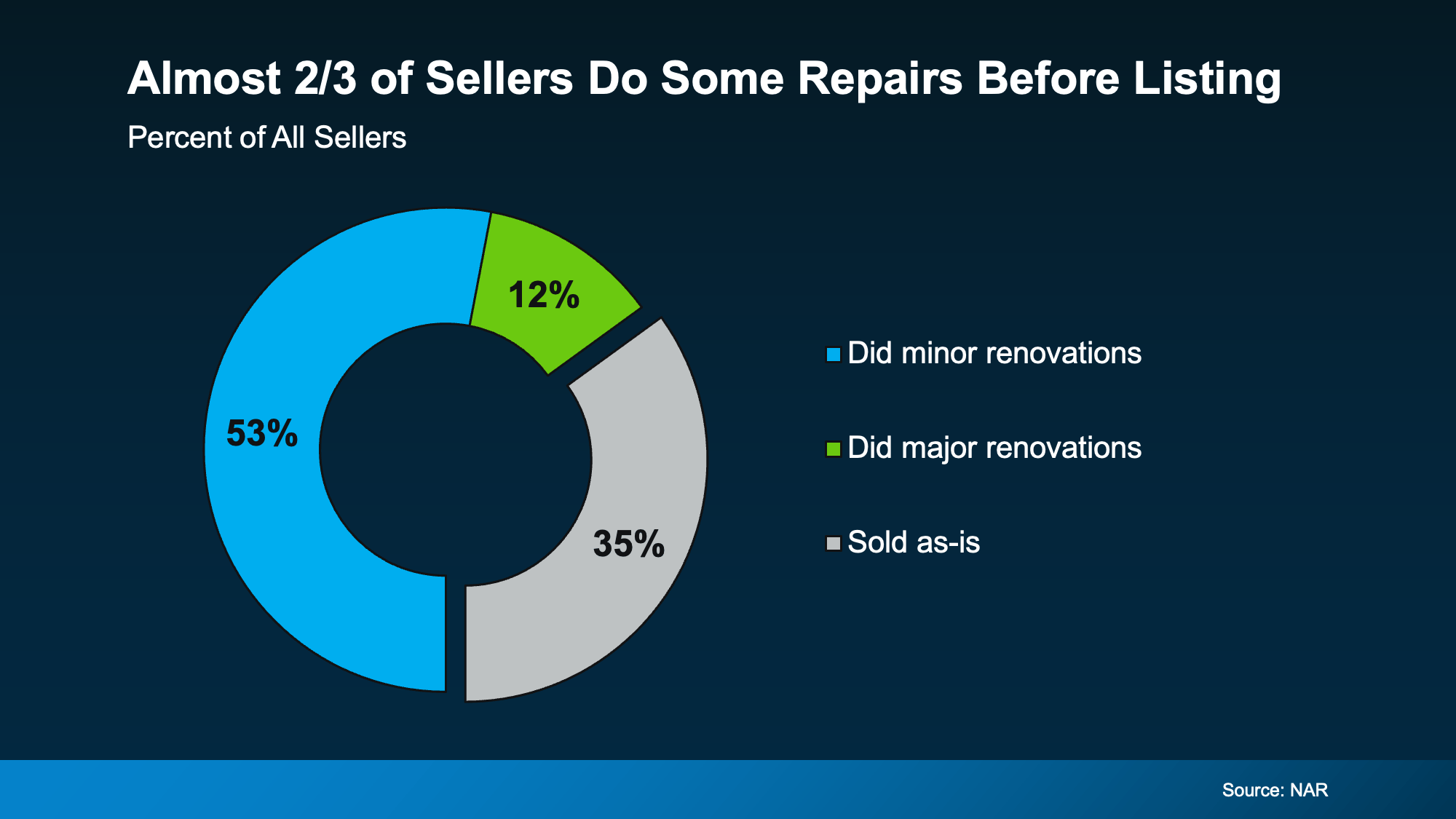

That’s one reason most sellers choose to make some updates before listing.

According to a recent study from the National Association of Realtors (NAR), two-thirds of sellers (65%) completed minor repairs or improvements before selling (the blue and the green in the chart below). And only one-third (35%) sold as-is:

What Selling As-Is Really Means

Selling as-is means you’re signaling upfront that you won’t handle repairs before listing or negotiate fixes after inspection. That can definitely simplify things on your end, but it also narrows your buyer pool.

Homes that are move-in ready typically attract more buyers and stronger offers. On the flip side, when a home needs work, fewer buyers are willing to take it on. That can mean fewer showings, fewer offers, more time on the market, and often a lower final price.

It doesn’t mean your house won’t sell – it just means it may not sell for as much as it could have.

How an Agent Can Help

How an Agent Can Help

So, what should you do? The answer isn’t one-size-fits-all. It’s going to depend a lot on your house and your local market.

And that’s why working with an agent is a must. The right agent will help you weigh your options and anticipate what your house may sell for either way – and that can be a key factor in your final decision.

- If you choose to sell as-is: They’ll call attention to the best features, like the location, size, and more, so it’s easy for buyers to see the potential, not just the projects.

- If you decide to make repairs: Your agent can pinpoint what’s really worth the time and effort based on your budget and what buyers care about the most.

The good news is, there’s still time to get repairs done. Typically speaking, the spring is the peak homebuying season, so there are still several months left before buyer demand will be at its seasonal high. That means you have time to make some repairs, without rushing or stressing, and still hit the listing sweet spot.

The choice is yours. No matter what you end up picking, your agent will market your house to draw in as many buyers as possible. And in today’s market, that expertise is going to be worth it.

Bottom Line

While selling as-is can still make sense in certain situations, in some markets today, it may cost you. So, no, you don’t have to make repairs before you list. But you may want to.

To make sure you’re considering all your options and making the best choice possible, let’s have a quick conversation about your house.

Reasons To Be Optimistic About the 2026 Housing Market

A Market That’s Finally Finding Its Footing

If a move is on your radar for 2026, here’s some good news: there’s a lot more working in your favor than there has been in a while.

After several years of tight inventory, fast decisions, and frustrating trade-offs, the housing market is starting to feel… more normal. Not “easy.” Not predictable. But balanced — and that’s a big deal.

2026 is shaping up to be a year with:

-

More options

-

More negotiating room

-

More clarity for both buyers and sellers

And this shift isn’t based on wishful thinking. It’s coming from economists across the industry who are seeing real changes in supply, affordability, and buyer behavior.

As Realtor.com Chief Economist Danielle Hale puts it:

“After a challenging period for buyers, sellers and renters, 2026 should offer a welcome, if modest, step toward a healthier housing market.”

Let’s break down why that matters, and what it could mean here in Walpole, West Roxbury, Roslindale, Dedham, Norfolk, Wrentham, and Westwood.

1. Inventory Is Slowly — But Meaningfully — Improving

For the past few years, the biggest challenge for buyers wasn’t interest rates. It was lack of choice.

Many homeowners felt “locked in” by low mortgage rates and simply didn’t want to give them up. The result? Fewer listings, more competition, and buyers making rushed decisions just to stay in the game.

That’s starting to change.

According to the National Association of Realtors (NAR):

“Top economists have one word to sum up the housing market for 2026: opportunity. Lower mortgage rates and a rising supply of homes are expected to open up the housing market.”

In our local Massachusetts markets, that likely means:

-

More listings coming online across multiple price points

-

Less pressure to waive protections just to compete

-

More realistic timelines for buyers and sellers

Inventory doesn’t need to flood the market to make a difference. Even moderate increases can dramatically change the experience.

2. Buyers Are Gaining Purchasing Power (Even If Rates Don’t Plummet)

Here’s a truth that doesn’t always make headlines: affordability isn’t only about interest rates.

Income growth, wage stability, and price appreciation all play a role — and for the first time in years, those forces are starting to line up.

Mark Fleming, Chief Economist at First American, explains it this way:

“Mortgage rates may drift down only slowly, but income growth exceeding house price appreciation will provide a boost to house-buying power.”

In practical terms, that means:

-

Buyers may qualify for more than they expect

-

Monthly payments become more manageable over time

-

Fewer people feel priced out before they even start

Especially in towns like Dedham, Roslindale, and West Roxbury, this could open doors for buyers who paused their plans in 2023–2025.

3. Sellers Are Seeing Price Stability — Not a Crash

One of the biggest fears sellers have right now is, “What if I wait too long and miss the peak?”

The good news? Most economists aren’t predicting a sharp drop in home values.

Mischa Fisher, Chief Economist at Zillow, sums it up well:

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand.”

That’s a healthier market for everyone.

For sellers in places like Westwood, Walpole, and Norfolk, this means:

-

Less urgency to “beat the market”

-

Strong pricing when homes are positioned correctly

-

Buyers who are serious, prepared, and intentional

Homes still sell well — they just sell with strategy, not frenzy.

4. Negotiation Is Back (Yes, Really)

For years, buyers had very little leverage. Multiple offers were common, inspections were skipped, and sellers held all the cards.

In 2026, negotiation is making a comeback.

You may see:

-

Inspection contingencies returning

-

Credits or concessions for repairs

-

More thoughtful offers instead of rushed ones

This doesn’t mean buyers suddenly control the market. It means both sides can have a real conversation again — and that’s a win for smoother transactions.

5. Why Local Insight Matters More Than Ever

Here’s the part that really matters — especially in Massachusetts.

National trends are helpful. Local trends are everything.

Lisa Sturtevant, Chief Economist at Bright MLS, explains it clearly:

“Market performance will hinge on local economic conditions, making 2026 one of the most geographically divided markets we’ve seen in years.”

What does that mean for you?

-

Walpole and Westwood may see stronger demand from move-up buyers

-

Roslindale and West Roxbury may attract buyers priced out of other Boston neighborhoods

-

Norfolk and Wrentham could benefit from buyers seeking space and flexibility

Same state. Same year. Very different outcomes.

That’s why understanding your specific market — not just the headlines — makes all the difference.

Bottom Line: A Smarter, More Balanced Market Is Taking Shape

2026 isn’t about timing the market perfectly.

It’s about being informed, prepared, and strategic.

If you’re thinking about:

-

Buying your first home

-

Selling and moving up

-

Downsizing or relocating

-

Or just understanding your options

This is a year worth paying attention to.

If you’d like to talk through what these trends mean specifically for your neighborhood, let’s connect. I’m happy to walk you through what’s happening locally and help you decide your best next move.

Your House Didn’t Sell. What Now? A Smarter Strategy to Get It Sold.

When your house doesn’t sell, it does more than disrupt your plans, it hits close to home. You prepared for the next chapter. You told people you were moving. You pictured where you’d go next. And then nothing happened.

It’s normal to feel frustrated, confused, or even a little embarrassed. But here’s the part you have to remember: just because your house didn’t sell the first time, doesn’t mean it won’t sell.

And here’s what most agents won’t tell you. In most cases, the difference typically comes down to the strategy behind the sale, not the house itself. And there’s real data to back that up.

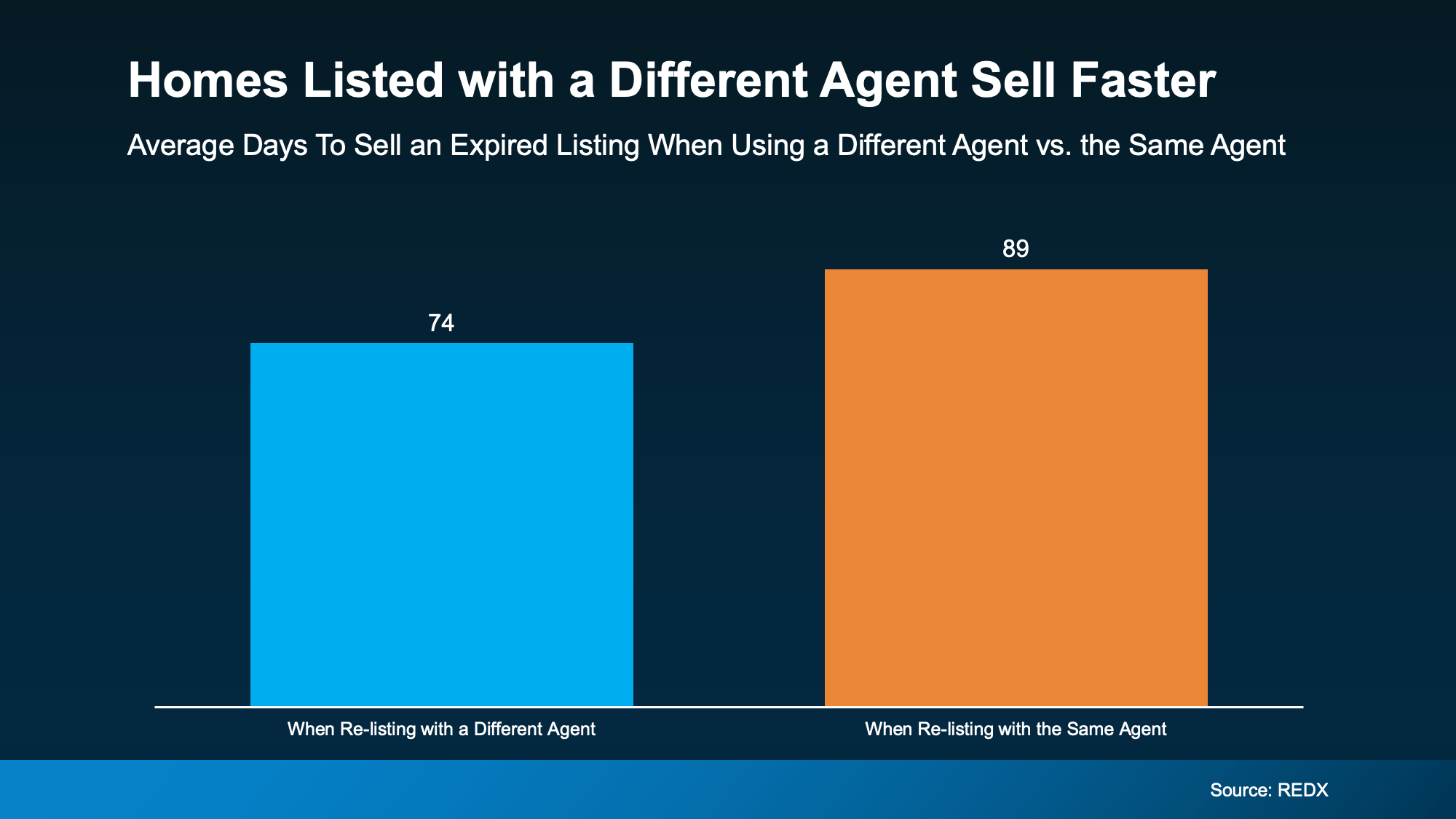

Research from REDX found over half (54%) of homeowners who re-list with a different agent end up selling their house. Re-list with the same agent? That stat drops to only 36%. You deserve better odds than that.

So, if your house didn’t sell, don’t stress. You’re not stuck. You may just need a different professional with a different approach.

So, if your house didn’t sell, don’t stress. You’re not stuck. You may just need a different professional with a different approach.

Because, at the end of the day, maybe the problem wasn’t the market or your home. It was the strategy.

Let’s break down what might’ve gone wrong – and how a fresh perspective can help you have a winning plan this time.

1. The Price Was Working Against You

A lot of sellers are aiming a bit too high these days, hoping to match the price their neighbor got during the 2021 frenzy. And that’s not working anymore.

Today’s buyers are being more selective. Even a slightly overpriced home will get overlooked today. And once your listing starts to go stale, it’s hard to regain momentum. The result? A widening gap between seller and buyer expectations (see graph below). That could be what cost you your sale.

The Fix: Get a fresh pricing analysis rooted in what’s happening right now in your neighborhood – not what happened in 2021. Sometimes even a small adjustment can bring the right buyers through the door. HousingWire reports many successful sellers only had to reduce their price by about 4% to get real traction. In the grand scheme of selling a home, it’s really not that much.

The Fix: Get a fresh pricing analysis rooted in what’s happening right now in your neighborhood – not what happened in 2021. Sometimes even a small adjustment can bring the right buyers through the door. HousingWire reports many successful sellers only had to reduce their price by about 4% to get real traction. In the grand scheme of selling a home, it’s really not that much.

2. Your House Didn’t Show Well

You only get one shot at a first impression. If the listing photos didn’t pop, the house wasn’t staged well, or it wasn’t updated, most buyers today will skip over it without ever scheduling a showing. And even if buyers did pass through, small things like scuffed walls, outdated light fixtures, or a wobbly doorknob can turn them away.

The Fix: Let’s walk through your house with fresh eyes to see if there are any areas that may have been sticking points inside and out. Sometimes simple updates (new paint, updated lighting, fresh landscaping, or better listing photos) can completely change how buyers react.

3. It Didn’t Get the Right Exposure

If your home didn’t sell, chances are it wasn’t getting the visibility it deserved. Generic flyers and a few online photos aren’t enough anymore. Today’s top agents are using highly targeted digital marketing, social media strategies, custom video content, and more to get your listing in front of the right buyers at the right time.

The Fix: We have to do more than just put your house online and hope it sells. With the right pricing, staging, and marketing, your house can still sell. It may even happen faster if you switch agents. Here’s a real-world example (see graph below):

4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate

In this market, flexibility matters. If you weren’t open to negotiating on repairs, closing costs, or other concessions, buyers may have walked, especially because many now expect at least some give-and-take.

The Fix: Be willing to meet buyers where they are. The goal is to get the deal done – and sometimes that means getting creative to cross the finish line. Home values have increased by 48.5% over the last five years, so you likely have enough wiggle room to offer some perks without sacrificing your bottom line.

Bottom Line

If your house didn’t sell and your listing has expired, you’re not stuck. You just need a better plan. And maybe, a better partner.

Same house. Different strategy. Completely different results.

If you’re ready to understand what held your sale back (and how to get it right this time), let’s take a fresh look together. A few strategic shifts could be all it takes to get your move back on track.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

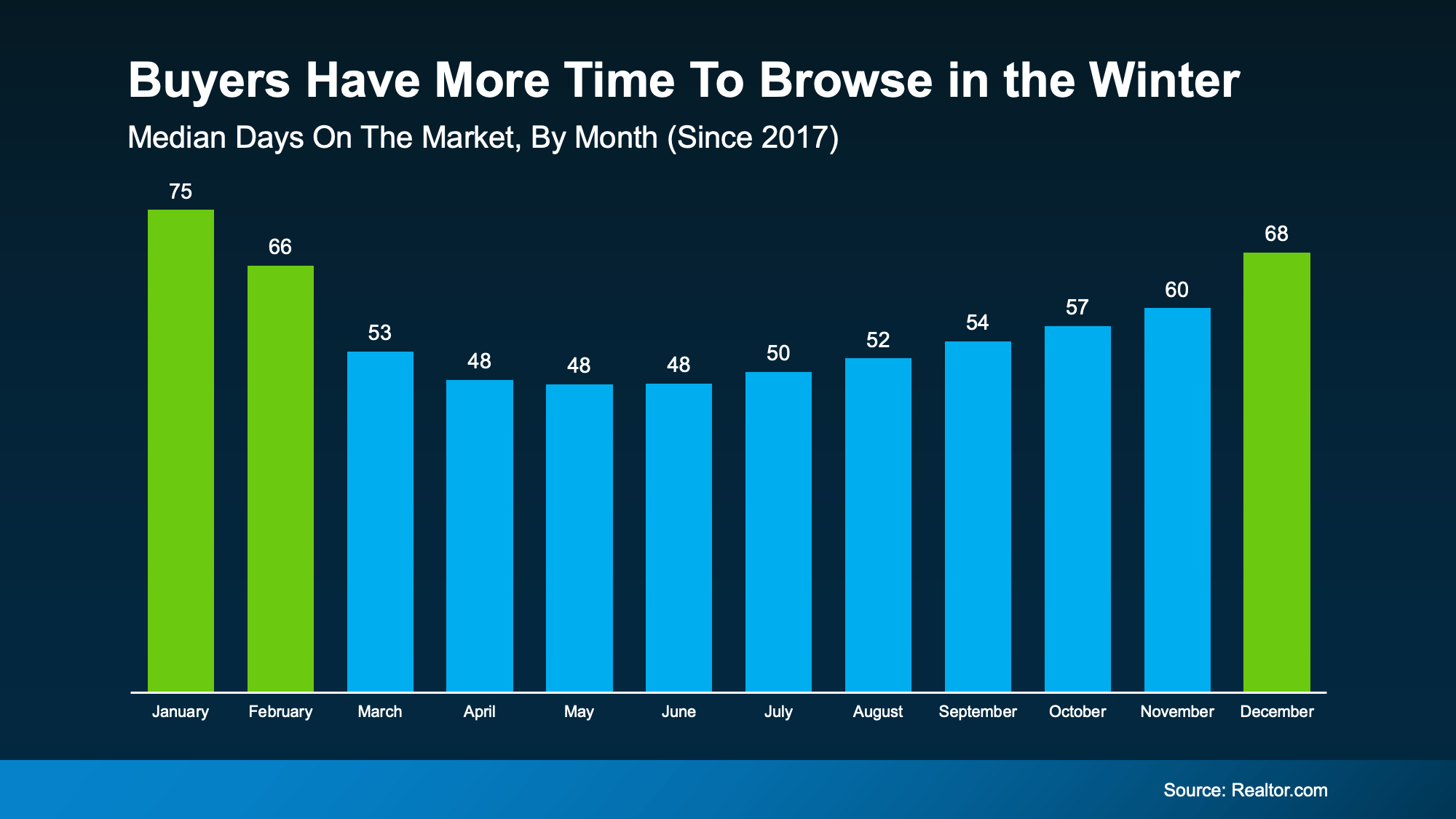

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

How an Agent Can Help

How an Agent Can Help 4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate