What a Government Shutdown Really Means for the Housing Market (and Why It’s Not the Disaster You Think)

The Big Question on Everyone’s Mind

There’s been a lot of talk lately about how a government shutdown might affect the housing market. If you’ve scrolled through the news or social media lately, you’ve probably seen headlines suggesting chaos and confusion. You might even be wondering if home sales grind to a halt when Washington does.

The short answer? Nope.

While a shutdown can cause a few speed bumps, it doesn’t stop the real estate market. Homes are still being bought and sold, contracts are still being signed, and closings are still happening. The difference is that a few parts of the process may slow down—but overall, the market keeps moving.

What Typically Happens When the Government Shuts Down

Whenever the federal government shuts down, certain agencies temporarily close or scale back operations. And since real estate has a few moving parts that depend on those agencies, some transactions experience small delays.

Here’s how it usually plays out:

-

Loan Processing Delays:

Buyers using FHA, VA, or USDA loans may experience delays in getting their loans processed. These types of loans make up roughly a quarter of all mortgage applications, and when agency staff are furloughed, approvals can take longer.“Applicants for FHA, VA, or USDA loans—which account for about one-quarter of all mortgage applications—may encounter significant processing delays due to agency furloughs.”

– Selma Hepp, Chief Economist at CoreLogic -

Flood Insurance Snags:

If you’re buying in a flood zone, federal flood insurance may be required to close. The National Flood Insurance Program (NFIP) sometimes pauses during shutdowns, which can temporarily stall closings until the government reopens. -

Verification Backlogs:

Lenders often rely on IRS and Social Security verification systems to confirm income or identity information. During a shutdown, those systems can slow or temporarily close, which creates a minor backlog in mortgage underwriting.

Even with those hiccups, most deals still move forward. Real estate agents, lenders, and attorneys have become experts at navigating these pauses. If a buyer’s loan requires a federal verification, for example, many lenders can proceed “subject to” confirmation once the system is back online.

The Housing Market Doesn’t Stop—It Just Slows Down Briefly

The important thing to understand is that the housing market doesn’t freeze—it flexes.

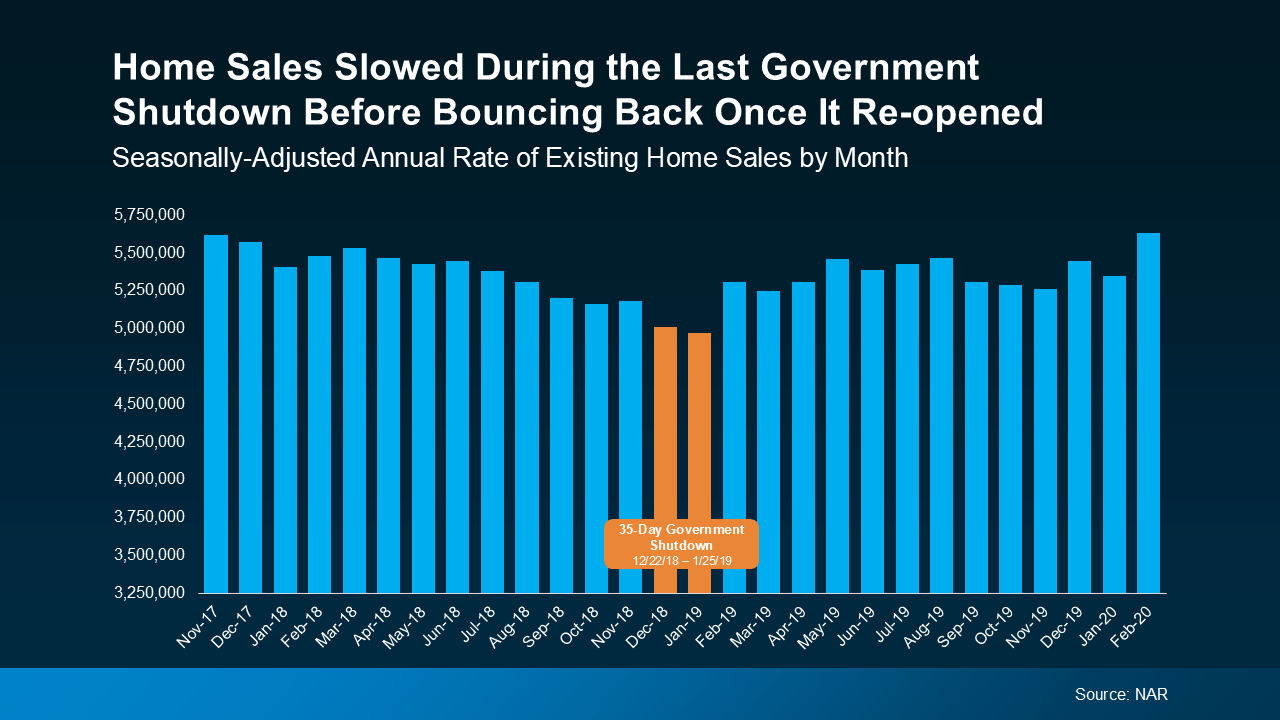

If you look back at the last major government shutdown, which lasted 35 days from December 22, 2018, to January 25, 2019, you’ll see what really happens.

According to the National Association of Realtors (NAR), home sales dipped slightly during the closure—but rebounded quickly once the government reopened.

The data shows a short-term slowdown during the shutdown (the orange bars), followed by a strong bounce-back as delayed closings were completed once federal offices reopened.

This wasn’t a seasonal drop—it directly lined up with the shutdown period. Once federal workers were back and loans started flowing again, pending transactions quickly closed, and home sales returned to normal levels.

Why the Market Bounces Back So Fast

There are a few reasons housing recovers quickly after a shutdown:

-

Demand Doesn’t Disappear:

Buyers who were ready to move don’t just walk away—they wait. Once systems are back online, those deals rush to the finish line. -

Inventory Stays Stable:

Sellers don’t suddenly pull listings because of government news. Homes remain on the market, creating pent-up activity once the delay ends. -

Confidence Returns Quickly:

Real estate is an essential need. Once the uncertainty lifts, both buyers and sellers regain confidence and the market quickly resets. -

Mortgage Rates Usually Stay Steady:

Rates are more influenced by inflation and the Federal Reserve than by a temporary shutdown. Historically, shutdowns haven’t caused dramatic swings in mortgage rates.

What This Means for Buyers and Sellers Right Now

If you’re currently under contract—or about to be—don’t panic. Most transactions will continue, even if they take a few extra days.

“If you’re expecting to close in a week or a month, there could be some slight delay, but I think for most people, it’s probably going to be a blip more than a real deal killer.”

– Jeff Ostrowski, Housing Market Analyst at Bankrate

If you’re in the early stages of house hunting or preparing to sell, this might even work in your favor. Here’s why:

-

Less Competition:

Some buyers and sellers take a wait-and-see approach during times of uncertainty. That means less competition for motivated buyers and more visibility for active sellers. -

Negotiation Leverage:

When fewer people are in the market, sellers may be more open to price negotiations or concessions—especially if they want to keep their timeline. -

Opportunity to Prepare:

If you’re thinking of selling in 2026, use this moment to tackle your pre-listing projects, update your home, and get it market-ready before activity spikes again.

What About Interest Rates and the Economy?

A government shutdown doesn’t directly cause mortgage rates to rise or fall. However, it can temporarily affect economic data reporting, which the Federal Reserve relies on to guide policy decisions.

If data releases are delayed, the Fed might take a cautious approach—potentially keeping rates steady longer. That could actually benefit buyers who lock in before rate volatility returns.

In short: while a prolonged shutdown might slow economic reporting, it’s unlikely to trigger any major housing crisis.

Local Impact: What It Means in Greater Boston and Beyond

Here in Massachusetts, the ripple effects are minimal. Buyers in communities like Walpole, Dedham, West Roxbury, Roslindale, Norfolk, Wrentham, and Westwood may see an extra day or two of waiting if their loan type relies on federal verification, but the broader market continues to function.

Local lenders, attorneys, and agents are well-versed in keeping transactions moving. If you’re planning to buy or sell this fall or winter, staying proactive—and working with experienced professionals—will keep you on track.

Bottom Line

A government shutdown can create short-term slowdowns, but it doesn’t derail the housing market. Historically, sales bounce right back once the government reopens.

If you’re in the middle of a transaction, stay calm and stay in communication with your agent and lender. And if you’re just starting your home search or planning your next move—now’s the perfect time to prepare strategically.

Let’s connect and talk through your situation so you can make informed decisions, no matter what’s happening in Washington.