Mortgage Rates Just Saw Their Biggest Drop in a Year

What Sparked the Drop?

According to Mortgage News Daily, the shift came right after the August jobs report—weak for the second month in a row. When the economy shows signs of slowing, financial markets start pricing in what’s next. Historically, that often nudges mortgage rates lower.

So while the headlines sound dramatic, here’s the takeaway: this isn’t just about one day of data, it’s about the larger direction the market may be heading.

What This Means for You

This rate drop isn’t just a number on paper. It translates into real dollars saved when buying a home.

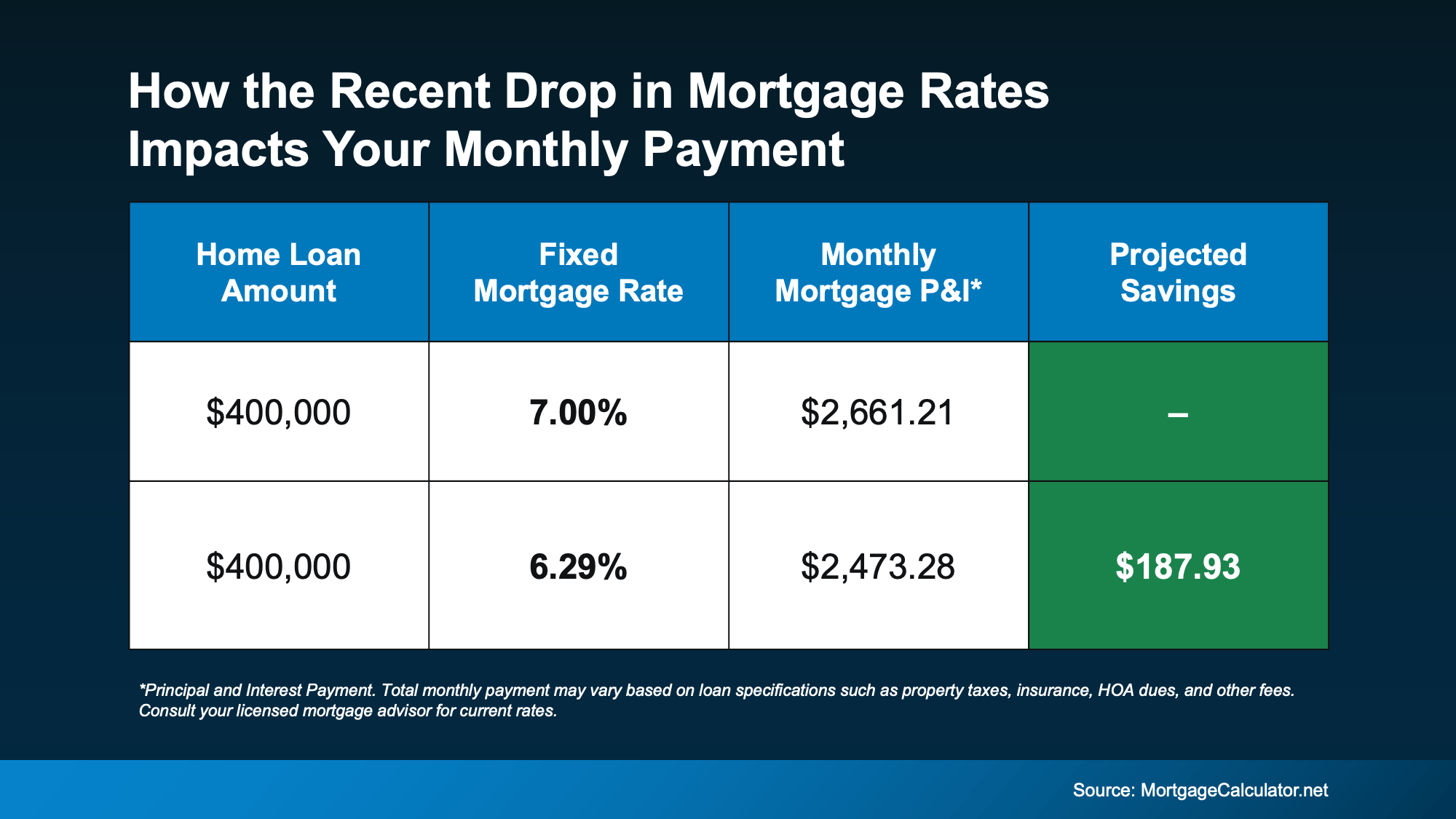

Take a look at this example for a $400,000 loan:

- At a 7% rate, the monthly principal and interest payment is about $2,661.

- At a 6.29% rate (where we are now), it drops to $2,473.

That’s a savings of nearly $188 every month. Over the course of a year, that’s about $2,250 back in your pocket.

And if your budget is tight, this kind of shift can be the difference between stretching too thin and feeling comfortable in your new home.

Will It Last?

Here’s the honest answer: no one knows for sure. Rates could continue easing, or they could tick back up depending on what happens with:

- Upcoming inflation data

- New jobs reports

- The Federal Reserve’s next policy moves

But what we do know is that mortgage rates have finally broken free from the rut they’ve been in for months. As CNBC’s Diana Olick puts it:

“Rates are finally breaking out of the high 6% range, where they’ve been stuck for months.”

That’s reason enough to pay attention.v

Why Buyers Shouldn’t Wait Too Long

If you’ve been thinking about buying in our local communities—whether a starter condo in Roslindale, a colonial in Dedham, or new construction in Walpole—this change could open the door for you. Even a small drop in rates can increase your buying power and make homes that felt out of reach just a few months ago suddenly possible again.

Bottom Line

This is the shift buyers have been waiting for. Mortgage rates just saw their biggest drop in over a year, and that could mean real savings for you.

Want to see what today’s rates could save you on your monthly payment? Let’s connect and run the numbers together.