Is It Better To Buy Now or Wait for Lower Mortgage Rates? Here’s the Tradeoff

Why Rates Are Back in the Spotlight

Mortgage rates are still a hot topic — and for good reason. After the most recent jobs report came out weaker than expected, the bond market reacted almost instantly. The result? In early August, mortgage rates dipped to 6.55%, the lowest level we’ve seen so far in 2025.

That might sound like a tiny change, but for buyers who have been anxiously waiting on the sidelines, it’s a big deal. Even a small drop reignites the hope that rates might finally be trending down. But before you grab your pre-approval letter, let’s talk about what’s realistic and why waiting for your “perfect” rate might actually cost you more.

What the Experts Are Saying About Rates

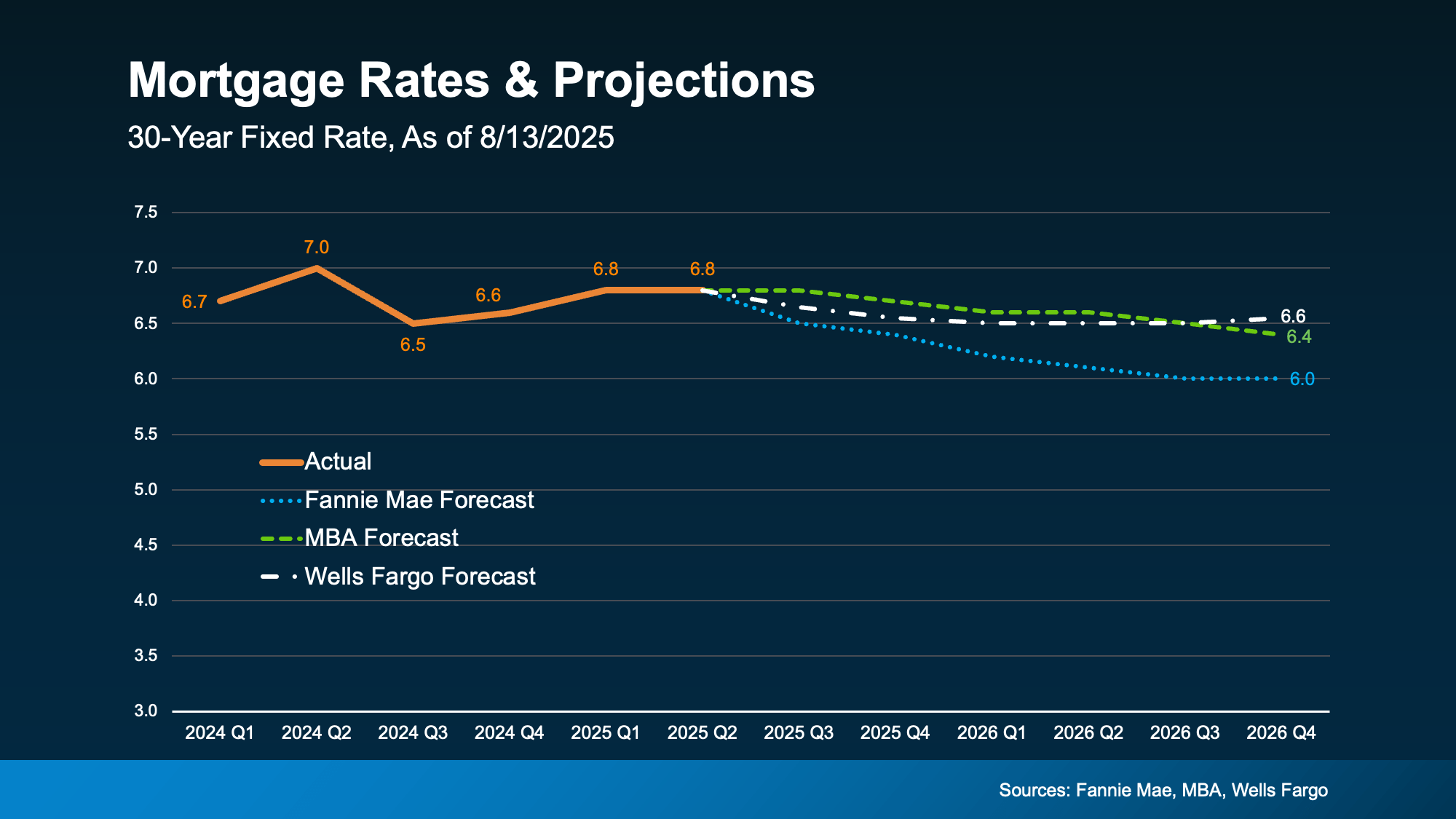

The latest forecasts don’t predict a dramatic fall any time soon. In fact, most experts expect mortgage rates to hover in the mid-to-low 6% range through 2026.

While big changes aren’t likely, small movements are — and those shifts usually happen in response to new economic data. With more reports scheduled for release this month, we could see some bumps (up or down) in the coming weeks.

The 6% Benchmark: More Than Just a Nice Round Number

The magic number for many buyers is 6%. It’s not just psychological — it has measurable impact.

According to the National Association of Realtors (NAR), if rates drop to 6%:

- 5.5 million more households could afford the median-priced home

- 550,000 people would likely buy a home within 12–18 months

That’s a lot of pent-up demand. And as the chart shows, Fannie Mae predicts we might hit that number next year.

The Tradeoff of Waiting

If you’re waiting for 6%, you’re not alone — and that’s exactly the problem.

When rates do hit that benchmark:

- More buyers will flood the market

- You’ll face fewer available homes

- Prices will likely rise due to competition

- Negotiating power will shrink

As NAR puts it:

“Home buyers wishing for lower mortgage interest rates may eventually get their wish, but for now, they’ll have to decide whether it’s better to wait or jump into the market.”

Why Now Might Be a Quiet Advantage

Right now, the conditions are surprisingly favorable for buyers — at least compared to what’s likely ahead:

- Inventory is up → More choices than in recent years

- Price growth has slowed → Sellers are more realistic

- Negotiating leverage → More willingness to cover closing costs or repairs

These advantages may disappear the moment rates fall enough to wake up the rest of the buyer pool.

Bottom Line

Rates aren’t expected to hit 6% this year — but when they do, the market will get crowded, fast. If you want more negotiating room, more choices, and less competition, your window might be open right now.

Let’s talk about what’s happening in Walpole, West Roxbury, Roslindale, Dedham, Norfolk, Wrentham, and Westwood — and whether it makes sense for you to make your move before everyone else does.