History Shows the Housing Market Always Recovers

When the market slows, it can feel like someone hit the pause button on your moving plans. Homeowners who hoped for top-dollar offers are increasingly choosing to take their homes off the market instead. According to Realtor.com, the number of homes being withdrawn is up 38% since the start of this year and 48% compared to last June.

In June alone, for every 100 new listings, about 21 were pulled back. If you’ve been in this position, you’re probably feeling frustrated—and rightfully so. But here’s the good news: slowdowns don’t last forever.

History Repeats Itself: Proof from the Past

This isn’t the first time the housing market has cooled down. In fact, history shows us that no matter the reason for a slowdown, the housing market always rebounds. Let’s look at a few examples:

- 1980s: Mortgage rates soared above 18%, pushing buyers out of the market. Once rates came down, home sales rebounded quickly.

- 2008: The Great Financial Crisis led to one of the toughest downturns in housing history. But even then, once the economy began recovering, sales and prices climbed back up.

- 2020: At the start of the COVID pandemic, home sales disappeared almost overnight. Yet within months, buyers came rushing back, creating one of the strongest housing booms in recent memory.

The lesson? Every slowdown is temporary.

Today’s Situation: Where We Stand Now

In the last few years, affordability has been the biggest challenge. Mortgage rates jumped at record speed in 2022 while home prices were also on the rise, making it harder for many buyers to qualify. Naturally, when fewer buyers are active, home sales slow.

That’s where we are today. Sales are sluggish, and many sellers are deciding to wait it out. But history—and the data—say this won’t last.

The Outlook: Why Things Will Improve

Here’s the encouraging part: the recovery is already on the horizon.

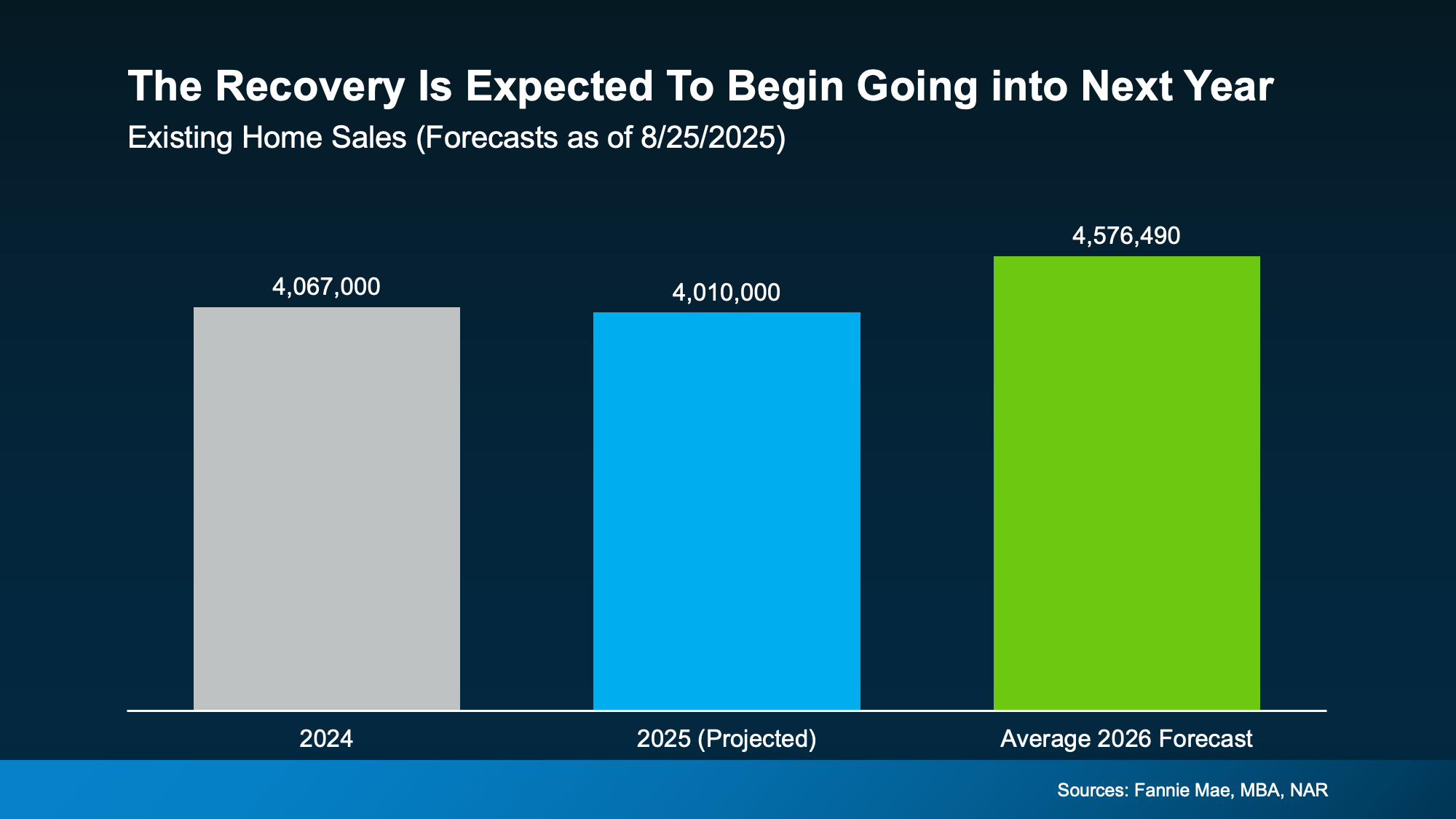

In 2024, about 4.07 million homes sold nationwide (gray bar below). This year, 2025, is projected to be nearly the same at 4.01 million (blue bar). But according to the latest forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR), 2026 could see an average of 4.57 million sales (green bar).

Why the jump? Experts expect mortgage rates to ease up, opening the door for more buyers to re-enter the market.

What That Means for You

If you’ve recently pulled your home off the market, you made the best decision for your situation. Your frustration is valid—but don’t lose sight of the bigger picture. Just like the 1980s, 2008, and 2020, today’s slowdown is temporary.

And when the rebound begins, the buyers who’ve been waiting on the sidelines will start showing up again. That’s why it pays to stay connected with a local real estate professional who can watch the market closely and help you time your re-entry.

Bottom Line

If today’s market feels stuck, remember: it’s never stayed that way for long. Activity always returns, and opportunities follow.

So the real question is: will you be ready when the next wave of buyers arrives?

Let’s talk about your goals and map out the best timing for you. [Get your free home valuation today!]